Q1 2021 MARKET UPDATE

MARKET TRENDS

Medical office properties faced a challenging year in 2020 due to Covid-19 but are well positioned for a relatively strong rebound in 2021. Health care employment is quickly recovering, and a build-up of patient demand is developing. The increasing use of telehealth is not expected to impact medical office space significantly. The resilience of the medical office market has been established, and investment trends have held up through this downturn, so the sector looks set for a faster recovery than most other asset classes. Some of the broader impacts of Covid-19 on society have also created multiple new opportunities for health care providers to better meet the needs of their patients. By April 2021, roughly 30% of the US population has been vaccinated. As this number increases, conditions in the US will normalise.

While annual investment volume declined by 12.7% for medical office buildings, this sector was the least impacted of any asset class by the downturn. Investor interest in medical office buildings appears to have grown, as it is increasingly being seen as a safe haven. Based on evidence from the last economic downturn, the relative durability of medical office investment activity should remain steady. The following table (Figure 4) compares investment volumes during the current recession with those seen during the Global Financial Crisis (GFC). Not only have medical office sales transactions held up in the current downturn, but the negative economic impact was less than during the GFC. It is interesting to note that medical office sales returned to their 2006 peak faster than all other property types after the GFC. The pricing stability of medical offices is also significant when comparing current trends in the price per square foot achieved in sales transactions during the current recession with those of other property types during the GFC. In Q4 2020, the average price per square foot of medical office transactions was 3.7% higher than in Q4 2019.

Results from the 2021 Emerging Trends in Real Estate® survey by PwC and the Urban Land Institute (ULI) show evidence of increased investor demand for medical offices as a result of the downturn that began in February 2020. Survey results shown in Figure 6 show “buy” recommendations for various property types in 2020 and 2021. Not only are medical offices one of the most sought-after property types for purchases in 2021, but investor interest increased year-on-year. PwC and ULI highlighted medical offices as one of their “Expected Best Bets in 2021.”

The US Census projects that in 2030 the US will reach a turning point in its demographics. By then, it is expected that all baby boomers will be older than 65. This is roughly one in every five Americans. By 2060, that ratio will be closer to one in every four Americans. It is expected that the number of people aged 65 and older will increase by 38.6 million over the next 40 years, reaching 94.7 million by 2060. By comparison with another generation, the under-18 population will reach 80.1 million by 2060, growing by only 6.1 million. This means that by 2034 senior adults will outnumber children for the first time in history. It is logical to expect that the value of and need for medical offices will increase.

Source: Colliers, CBRE & Our World in Data

OVERALL STATE OF HEALTHCARE IN THE U.S.

2020 will always be remembered as the year of the pandemic and its devastating impact on the healthcare system. Another major event of 2020 was the election of President Biden and his promise to make legislative decisions that could dictate the course of health care for years to come in the US. We expect to see bi-partisan support for changes in health care insurance that will include additional telehealth coverage, prescription drug reform, and a movement away from fee-for-service models towards value-based programs that support lower costs with higher quality.

The proposal for “Medicare for More” could potentially expand Medicare by 20 million people by lowering the age of eligibility to 60. Medicare would benefit from the addition of younger and healthier people, thus reducing per capita costs. In addition, younger generations could also benefit by removing the less fit older generation from their private plans, thereby lowering their costs.

CONCLUSION

The medical office real estate sector has shown overall steady growth, as well as a marked turnaround in the submarket in which OrbVest has investments. Refer to details in the submarket review below.

The industry has survived well through the pandemic and is showing stability and growth. The US has made rapid progress in rolling out the Covid-19 vaccine and we anticipate the further roll-out will result in a return to normal economic conditions over the coming months.

Source: CBRE, Colliers, Our World in Data

MARKET DATA - REFERENCE

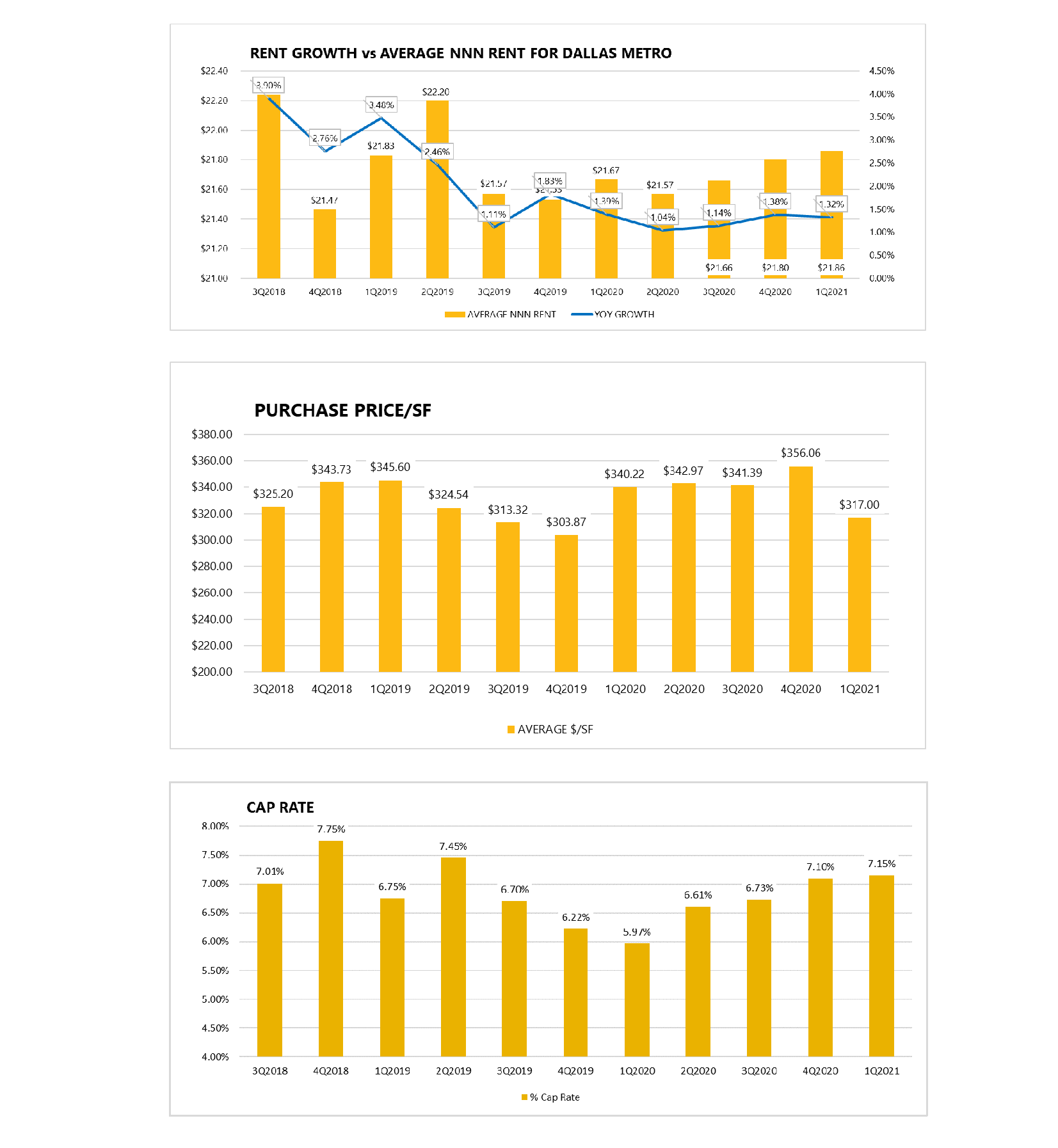

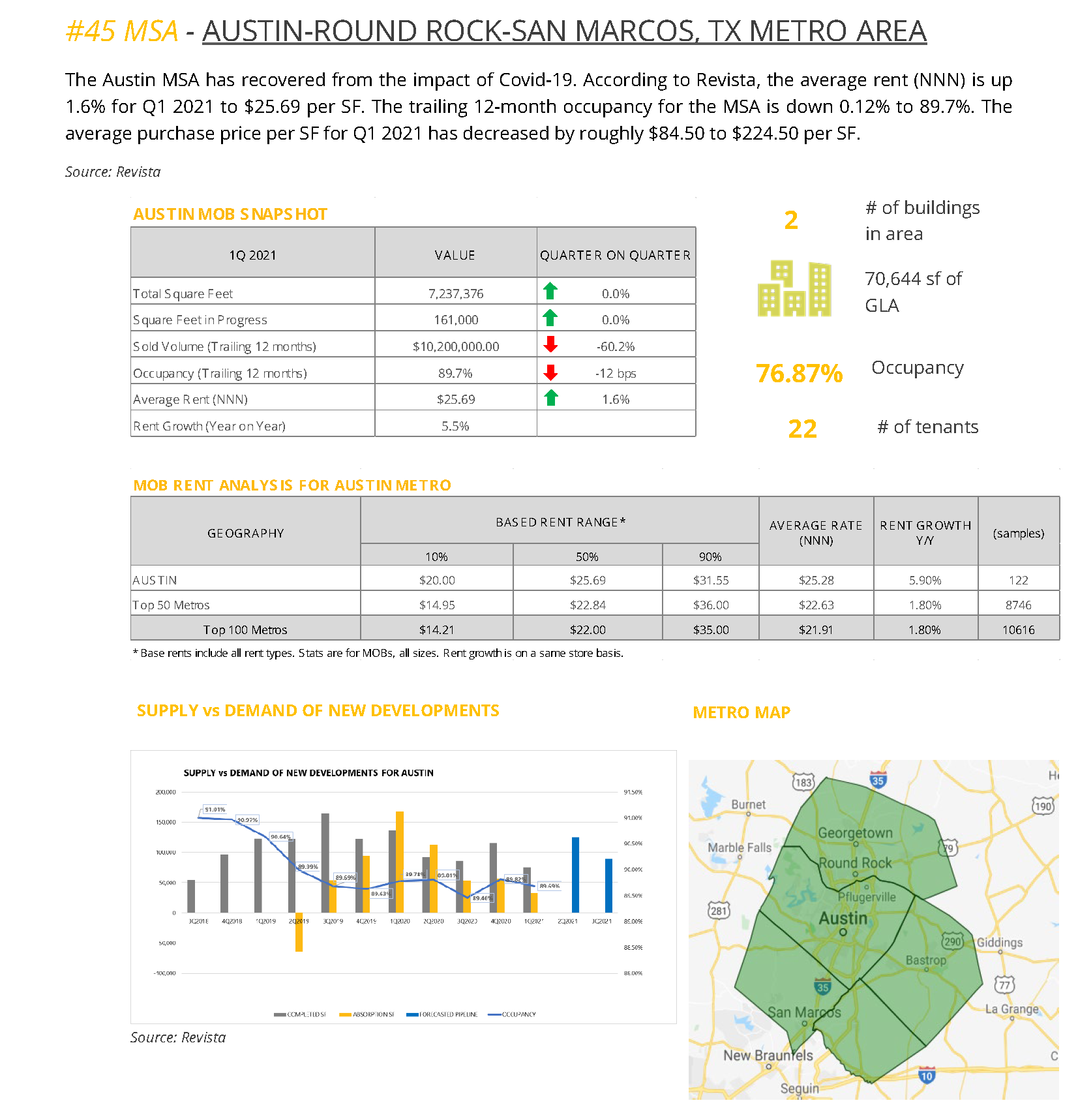

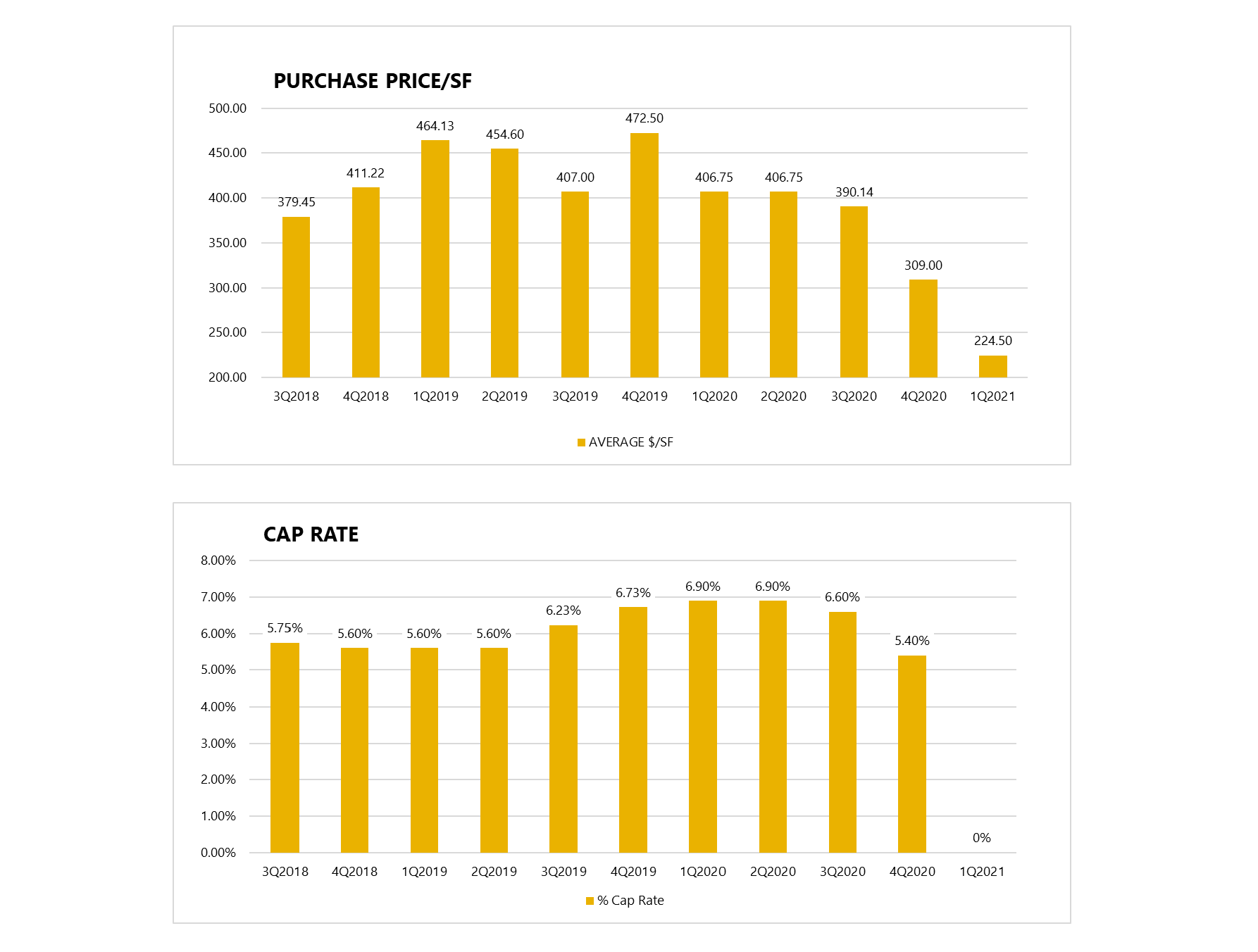

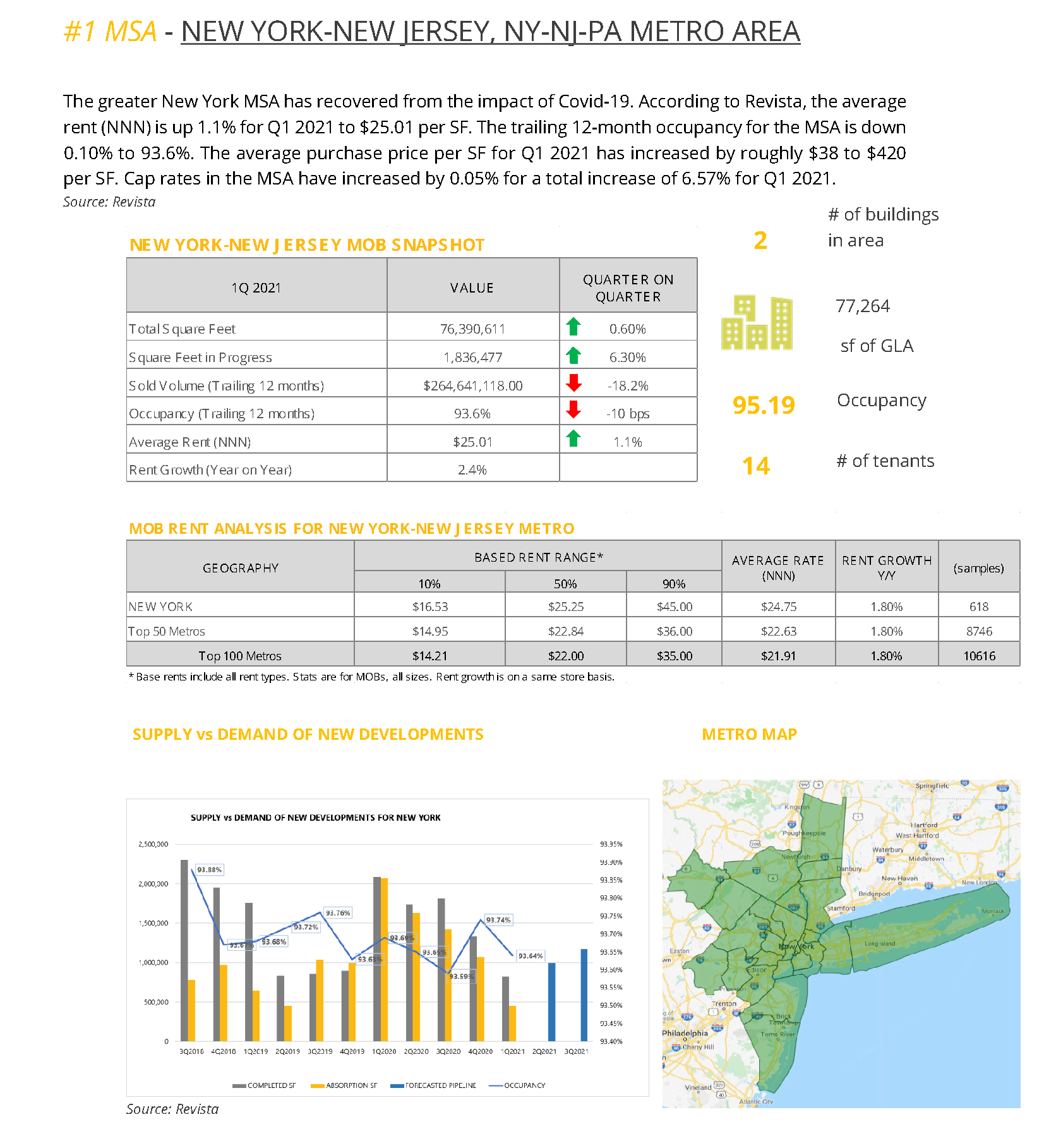

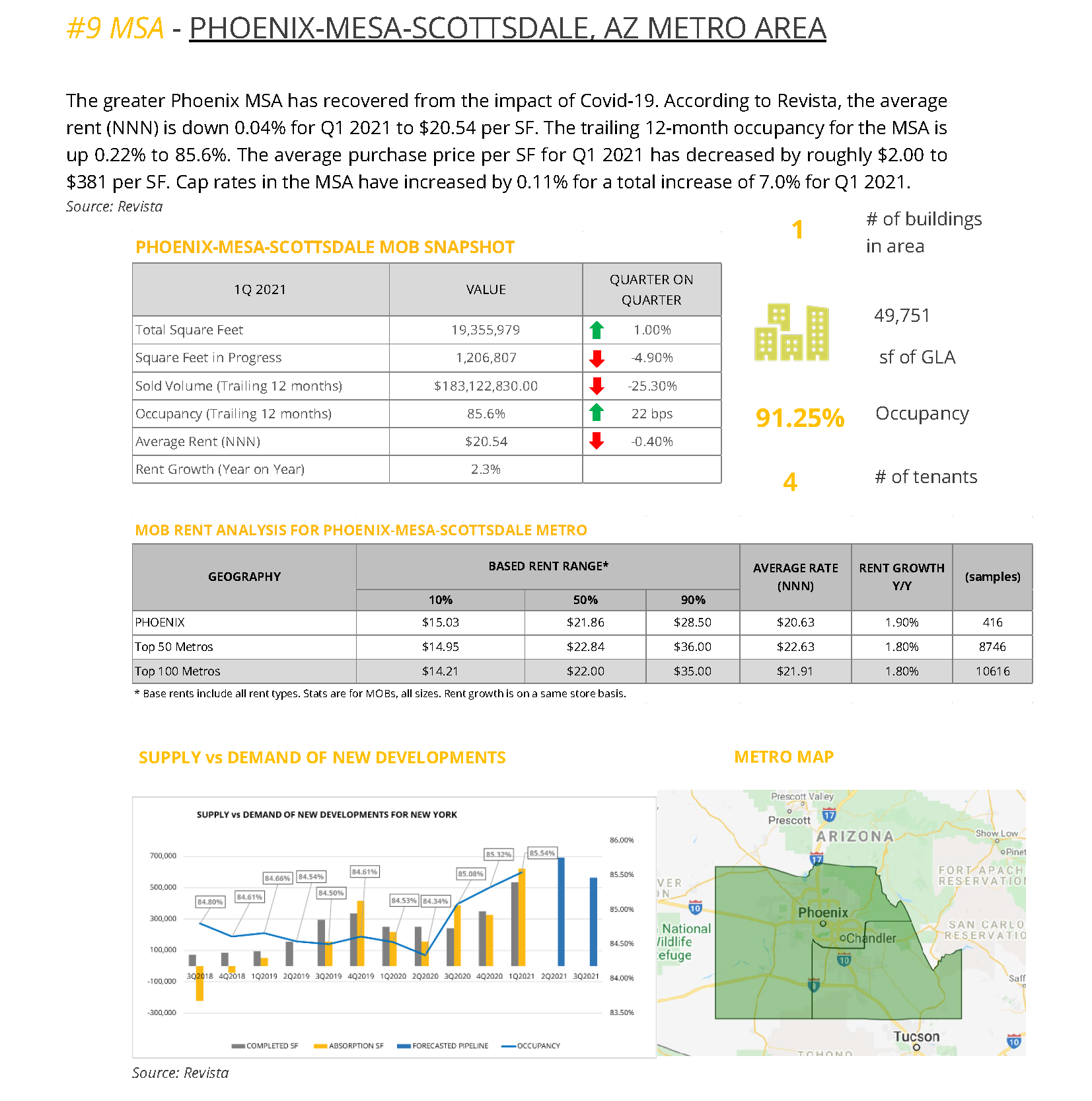

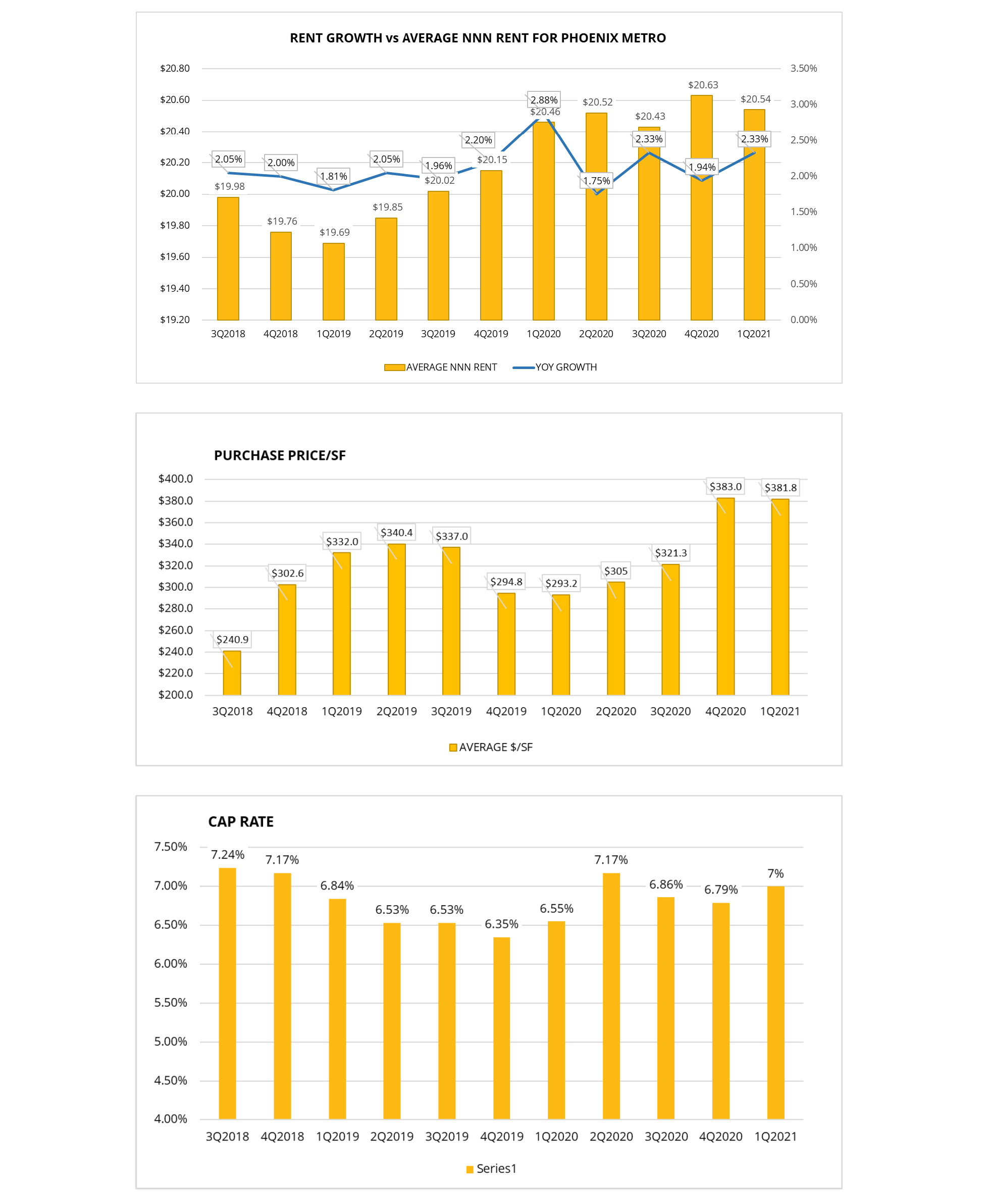

The seven Metro reports from Revista, in which Orbvest is managing assets, have been added as a reference below. The data reflects the period of Q1 2021 that shows the recovery in the market post Covid-19. As can be seen below, the impact of Covid-19 is evident differently in each Metro.

Disclaimer

The content and information herein contained and being distributed by Orbvest are for information purposes only and should not be construed, under any circumstances, by implication or otherwise, as advice of any kind or nature, or as an offer to sell or a solicitation to buy or sell or to invest in any securities or currencies herein named. The information was obtained from sources believed to be reliable but is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. Past performance does not guarantee future performance.

Any market data or information used herein is for illustrative and informational purposes only. Please get the advice of a competent advisor before investing your money in any financial instrument or product and it is your responsibility to obtain the necessary legal, tax, investment, financial or any other type of advice in this regard.

Sources: REVISTA, WALL STREET JOURNAL, AVISON YOUNG RESEARCH, BLOOMBERG, DALLASFED.ORG AND U.S. BUREAU OF LABOR STATISTICS LATEST NUMBERS.