ACCRETIVPLUS LIQUIDITY EVENT - HOW TO PARTICIPATE

AccretivPLUS Liquidity Event - How to participate

AccretivPLUS is an alternative investment in underlying commercial real estate and is naturally illiquid. The strategy to obtain the best possible returns for investors is to exit between 4 and 5 years when we expect interest rates to have dropped off their current highs, and that would lead to improved cap rates, so much higher bids for our portfolio at that point, which means more money in your pocket if you stay the course.

But we understand that many have already been in older investments that have been consolidated or simply have had a change of circumstance and need to free up some capital. For this purpose, we have promised annual liquidity events where the company will buy back shares.

What does this mean?

AccretivPLUS will buy back a pre-determined amount of shares every year, so if you need access to some of your capital, you can follow the steps below and sell a portion of your investment back to the company. We don’t recommend selling shares in this environment as you will not have the benefit of any capital gain. The offer from the company is to pay par less 5% transaction fees. So, if you invested $10,000 you will get $9,500 back. But you would have enjoyed the benefit of dividends in USD and hopefully, some good exchange rate wins.

How does AccretivPLUS decide who to buy from?

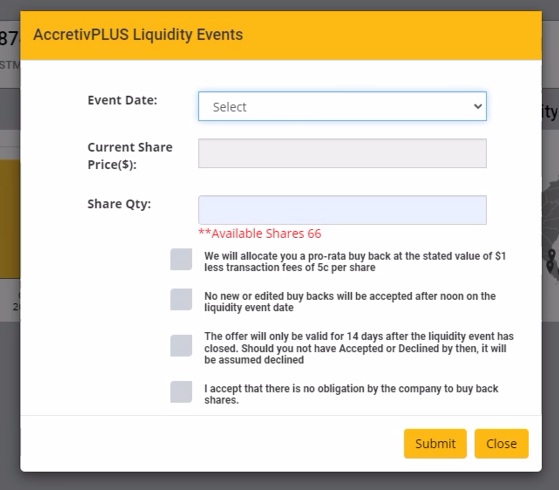

When submitting your offer to the company, note that the cut-off will be 12h00 on the 30th of June, and immediately the company will calculate the number of shares offered by investors and divide that total by the first buyback of $1m. You will therefore receive a pro-rata allocation. We suggest that you offer more than you wish to sell because it is highly probable that this round will be oversubscribed.

OK, how do I get going?

To participate you would need to;

- Visit www.orbvest.com/login , then navigate using the top right navigation button named “dashboard”:

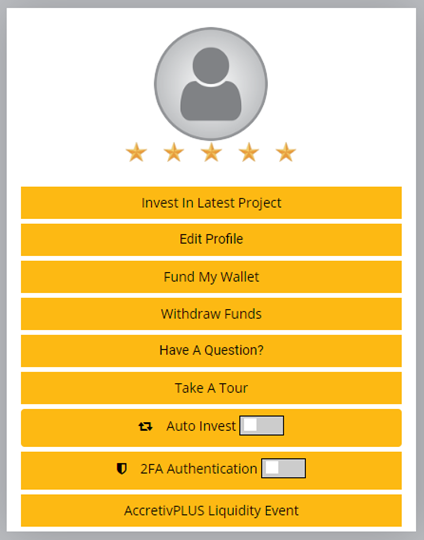

- Upon accessing the dashboard, investors will navigate to the "AccretivPLUS Liquidity Event" tab located on the bottom left-hand side of the screen, adjacent to their profile name.

- Upon selecting the Liquidity event button, a pop-up window will appear, allowing you to specify the desired date (June 2024) and quantity of shares you wish to sell. The selling price of the shares will prepopulate and the number of shares you currently own will be visible in red.

- Review and accept the terms and conditions presented in the pop-up and submit your offer.

- After the offer is closed on the cut-off date of 30 June 2024 at noon, the full list of the shares offered will be divided by the buyback capital of $1m and a pro-rata amount will be calculated.

- You will receive an automated email containing an offer and inviting you to again log on the platform and accept. Declining the offer will remove it from the dashboard and the offer by the company is automatically withdrawn. The offer will only be valid for 14 days at what point the offer will assumed to be declined.

- If accepted, an off-market trade form will be auto-populated and made available to you using DocuSign on the platform for your signature.

- The trade will be forwarded to PKF Capital for execution and payment to your wallet.

We don’t advise this as it will trigger an immediate re-KYC which can delay you receiving your funds. Your bank account is on record and these details will be used to populate the trade form. PLEASE NEVER PROVIDE YOUR BANK DETAILS, OR ACCESS TO YOUR BANK, TO ANYONE. IF YOU RECEIVE A CALL TO VALIDATE YOUR ACCOUNT DON’T OFFER ANY ACCOUNT DETAILS ON THE PHONE.

Can I change my offer if I change my mind after submitting it?

Yes, simply log in and redo the process. Your final number will only be adjudicated at the cut-off. NOTE that no changes can be made after 12h00 on 30 June 2024.