CEO UPDATE : THE GOOD, THE BAD AND THE UGLY...

We have been incredibly busy this quarter, and it has been both exciting and positive on the one hand but with some frustration and concern on the other.

A global repositioning is being shaped by the two terrible wars that are persisting, and at the same time, much of the world is facing elections which further amplifies the political rhetoric and economic uncertainty. I am concerned about global dynamics but am comfortable that our healthcare real estate remains robust, consistent, and what gives me the most comfort is that it is not correlated to the equity markets, which are most sensitive to global events. I am happy with the healthcare niche we remain focused on and even in this environment we have set a new record again this quarter distributing $1,492,808 to our investors globally which we are incredibly proud of.

The US economy remains strong and more resilient than economists had predicted, and the Fed’s strategy of bringing inflation back within the 2% per annum range is trending in the right direction with April Core CPI of 3.4% YOY, which in turn should bring the reduction in interest rates debate back onto the table. The impact of this is that it is the time to acquire real estate assets in the US with prices artificially depressed. Conversely, most landlords are holding back on selling buildings across almost all asset classes until interest and cap rates fall.

The most exciting thing this quarter is the acquisition of the Forest Plaza building in Dallas, which closed on 2 May. As many of you know, we have been working to take over distressed buildings from the sponsor Richmond Honan over the past several years. Finally, we acquired this magnificent tower block in Dallas from the lender through our new partner who will be working with us to restore the asset. While this building was acquired at an exceptional price of only $50 sf, there is still a lot of leasing work to be done which will be positive for both old and new investors. The demand for this project was unbelievable and it was oversubscribed within days of the offering being made available to our investors. While potential returns on these high value-add investments are very attractive, investors are reminded that a certain level of risk always goes with opportunistic investments.

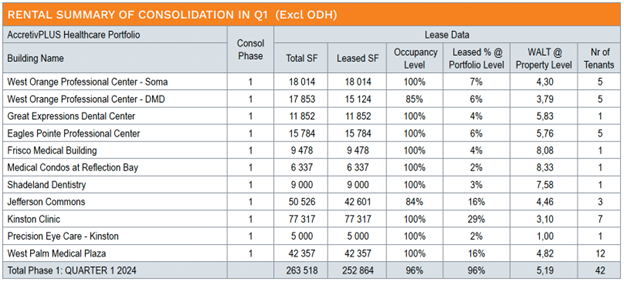

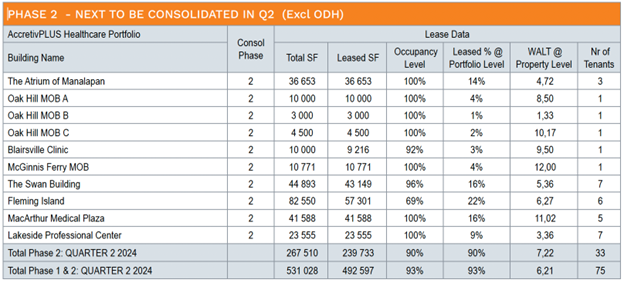

We have spoken previously about our preference for a lower-risk diversified portfolio of healthcare buildings to provide a product that truly is a good store of wealth and produces constant and consistent cash dividends but with some added upside from capital growth. The consolidation of our AccretivPLUS portfolio is moving forward with speed and now that distributions have been paid for the first quarter, we are looking to incorporate the next batch of buildings into AccretivPLUS this month.

Our US “AccretivMED Real Estate Fund 1” is also progressing, and we hope to announce its launch in the US soon. Some of our onshore investors (US-Accredited investors or LLCs) may prefer to move their investments into the fund and we are investigating this. We need to reiterate that the ownership structure at the level of the onshore investors remains the same and the consolidation will have no impact on their current investments.

Already new tools are available for AccretivPLUS investors including “auto invest” and “auto withdraw” but our first liquidity event is approaching on the 30 June where the company will (in terms of the listing document) buy back $1m of equity at $1 less 0.05c transaction fees. This is a long-term investment and not the best time to sell down, but we invite you to use the platform here to offer your shares back to the company. More on this in the article below. I would like to thank everyone for their continued support during the consolidation. Our entire purpose is to add as much value to this portfolio and the buildings that we touch and to find the best exit opportunities for us all.

Martin Freeman

OrbVest CEO