MARKET UPDATE - 2021 Q4

MARKET TRENDS - U.S. ECONOMY OUTLOOK

Real estate economists are maintaining a positive outlook for the US economy and commercial real estate in 2022. This outlook is made despite uncertainty over potential impacts of the COVID omicron variant and other risks. While the new variant will impact the timing of a large-scale return to the office, fiscal and monetary policy remains highly supportive of US economic growth. There may be other issues along the way, notably from the ripple effects of an economic slowdown in China and rising oil prices, but the factors that held back growth in 2021 (labor shortages, supply disruptions, inflation and other COVID variants) should slow down.

Monetary policy will tighten to keep longer-term inflation pressures in check, which may trigger some short-run volatility in the stock market, but it will not be enough to decrease investor demand for real estate. Real estate economists foresee a record year for commercial real estate investment, enabled by high levels of low-cost debt availability and new players drawn to real estate debt’s attractive risk-adjusted returns. The outlook for real estate in 2022 is positive, with big cities potentially surprising on the upside.

Source: CBRE Research

INTEREST RATES & INFLATION IN THE U.S.

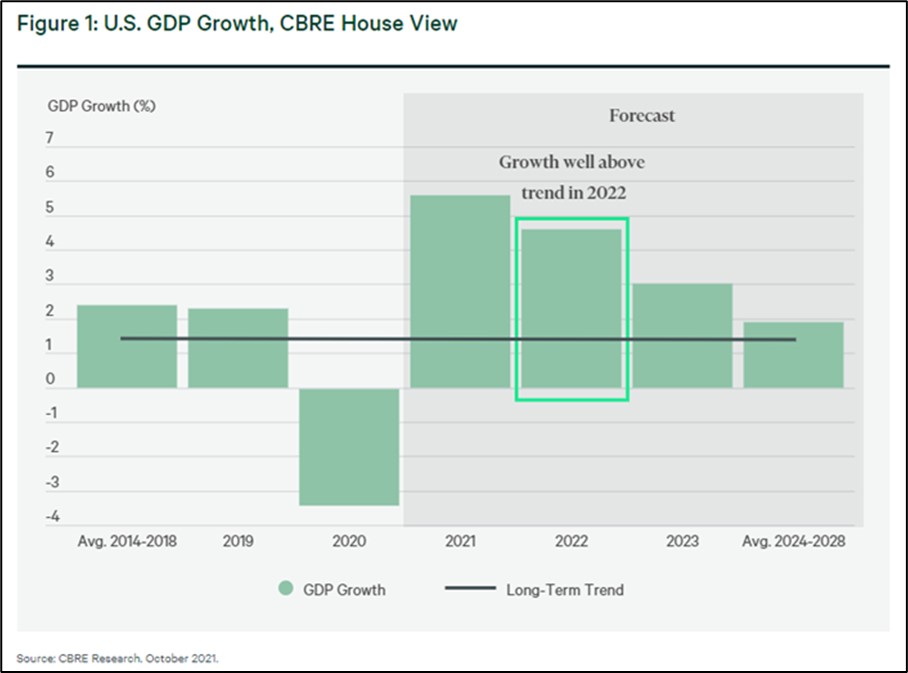

Inflation should remain well above the Fed’s 2% target through the first half of 2022 but is expected to increase just 2.5% for the full year as supply chain and other economic factors keep pushing it up. While pandemic-related disruptions should continue, the economic outlook is still bright, with 4.6% GDP growth expected for 2022. In terms of GDP, the US has fully recovered from the pandemic created recession of 2020. Real estate’s recovery is generally in full force, with some sectors progressing more than others. The pace of GDP growth is expected to slow in 2022 from 2021’s exceptionally high level but should remain above the long-term trend for the US. Along with low interest rates, strong economic growth should provide highly supportive conditions and environment for commercial real estate.

As the delta and omicron variants revealed themself, the pandemic’s course of direction is difficult to predict. COVID is expected to endure in some form for the foreseeable future, However, society is learning to adapt to life with the virus and the ability to manage its effects has improved considerably. This is change is mainly due to broader vaccine availability to the public and the emergence of antiviral and antibody therapeutics. While COVID-19 will remain present in 2022, its impact on people, health-care systems and the economy should not have as big of an impact as it did in 2020 and early 2021.

INFLATION AND INTEREST RATES IN FOCUS

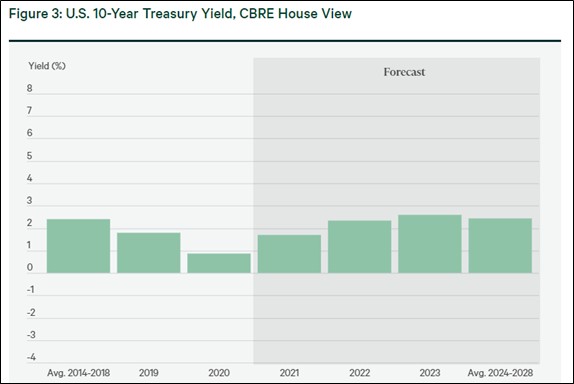

Inflation reached multi-decade highs in the U.S. during 2021, largely due to strong economic growth, labor shortages and hobbled supply chains. All of this conspired to increase costs for products and services. We expect that price increases (as measured by Core PCE, the Federal Reserve’s preferred measure) will remain elevated during the first half of 2022 but will increase just 2.5% for the full year amid cooling economic growth and fewer supply chain constraints. Headwinds to growth in China—the world's second largest economy—are a risk to growth in the U.S. and could impact the timing of monetary policy adjustments. Given the strong economic recovery and inflationary pressure, we expect the Fed will end its emergency quantitative easing—a key policy response to increase liquidity and improve market functioning during the pandemic—by mid-2022. This will set the stage for an increase in the federal funds rate, with the potential for more than one rate hike before year's end. However, we do not foresee interest rates rising sharply enough to disrupt property markets, with the 10-year Treasury yield expected to reach 2.3% (from 1.4% in early December) by the end of 2022.

Economists expect US GDP to expand by a historically strong 4.6% in 2022. All four quarters are expected to see more than double the long-term trend of around 2%. The recently enacted Infrastructure Investment and Jobs Act (as well as the social spending proposals under consideration as of this writing) may add some upside potential to our 2022 growth forecasts, with greater impact in 2023 and beyond.

Inflation reached a high for the past several decades in the US during 2021. This was largely due to strong economic growth, labor shortages and hobbled supply chains. All of this added up lead to increase costs for products and services. We expect that price increases (as measured by Core PCE, the Federal Reserve’s preferred measure) will remain elevated during the first half of 2022 but should increase just 2.5% for the full year and slowing economic growth and fewer supply chain constraints. China (the world's second largest economy) adds additional risks to growth in the US and could impact the timing of monetary policy adjustments. Given the strong economic recovery and inflationary pressure, we expect the Fed will end its emergency quantitative easing by mid-2022. This emergency easing is a key policy response to increase liquidity and improve market functioning during the pandemic. This will set the stage for an increase in the federal funds rate, with the potential for more than one rate increase before year's end.

Source: CBRE Research

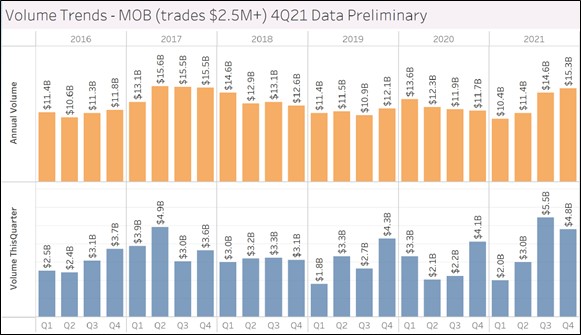

Source: Revista

The above chart shows that since the 1Q of 2021, Medical office sales volume has increase significantly. We believe that this trend will continue into 2022. This increase over the past four quarters is roughly a 47% increase. As the US economy becomes more stable, we believe that this sales volume will continue to increase as we move further into 2022.

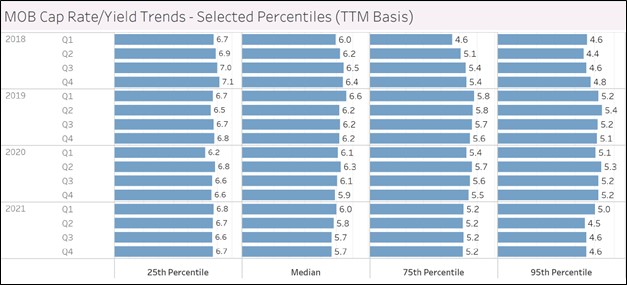

Source: Revista

The chart above shows that cap rates in the US for medical office continue to compress since the beginning of 1Q 2021. We believe that this trend will continue into 2022. For median cap rates, the medical office industry saw a 0.3% decrease in cap rates from 6.0% to 5.7%. We believe that cap rates for medical office will continue to stay low as it is a desired and resilient commercial real estate asset.

CONCLUSION

The medical office real estate sector has shown overall steady growth as well as a marked turn-around in the submarket in which OrbVest has investments. Refer to the detailed submarket review below. The healthcare commercial real estate niche has survived well through the pandemic and is stabilized and growing. Data shows that US healthcare commercial real estate will be in demand in the future.

MARKET DATA - REFERENCE

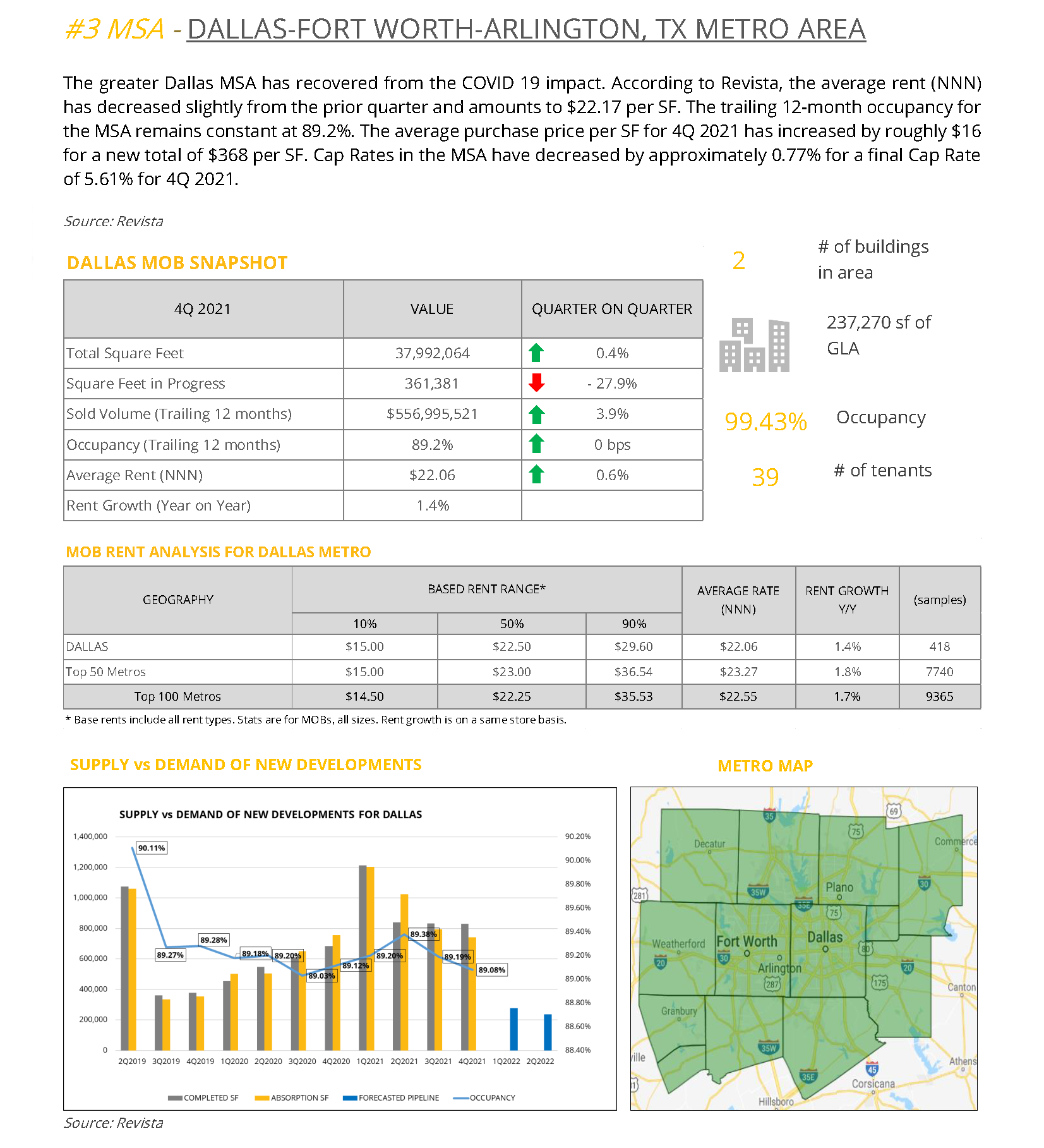

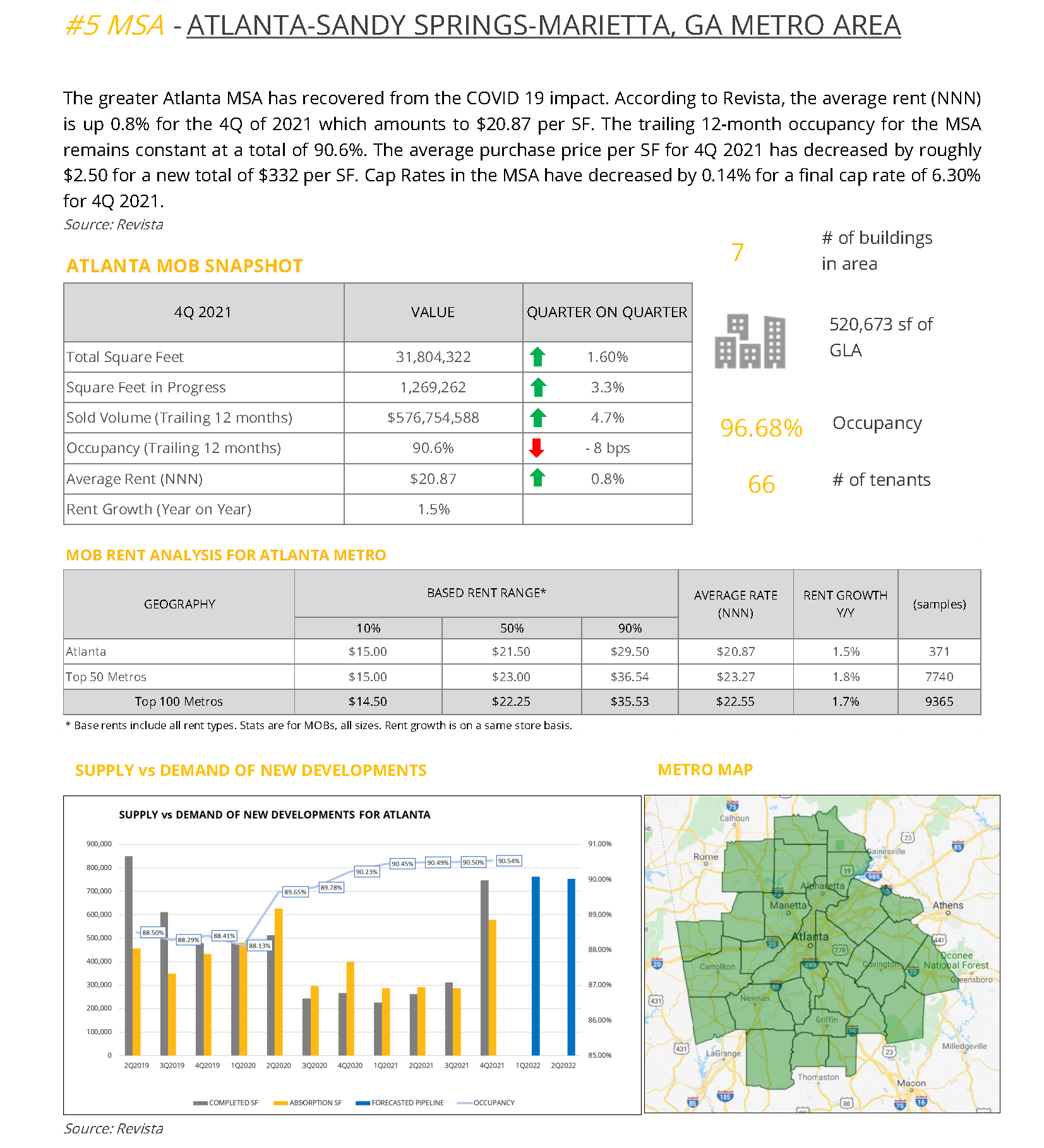

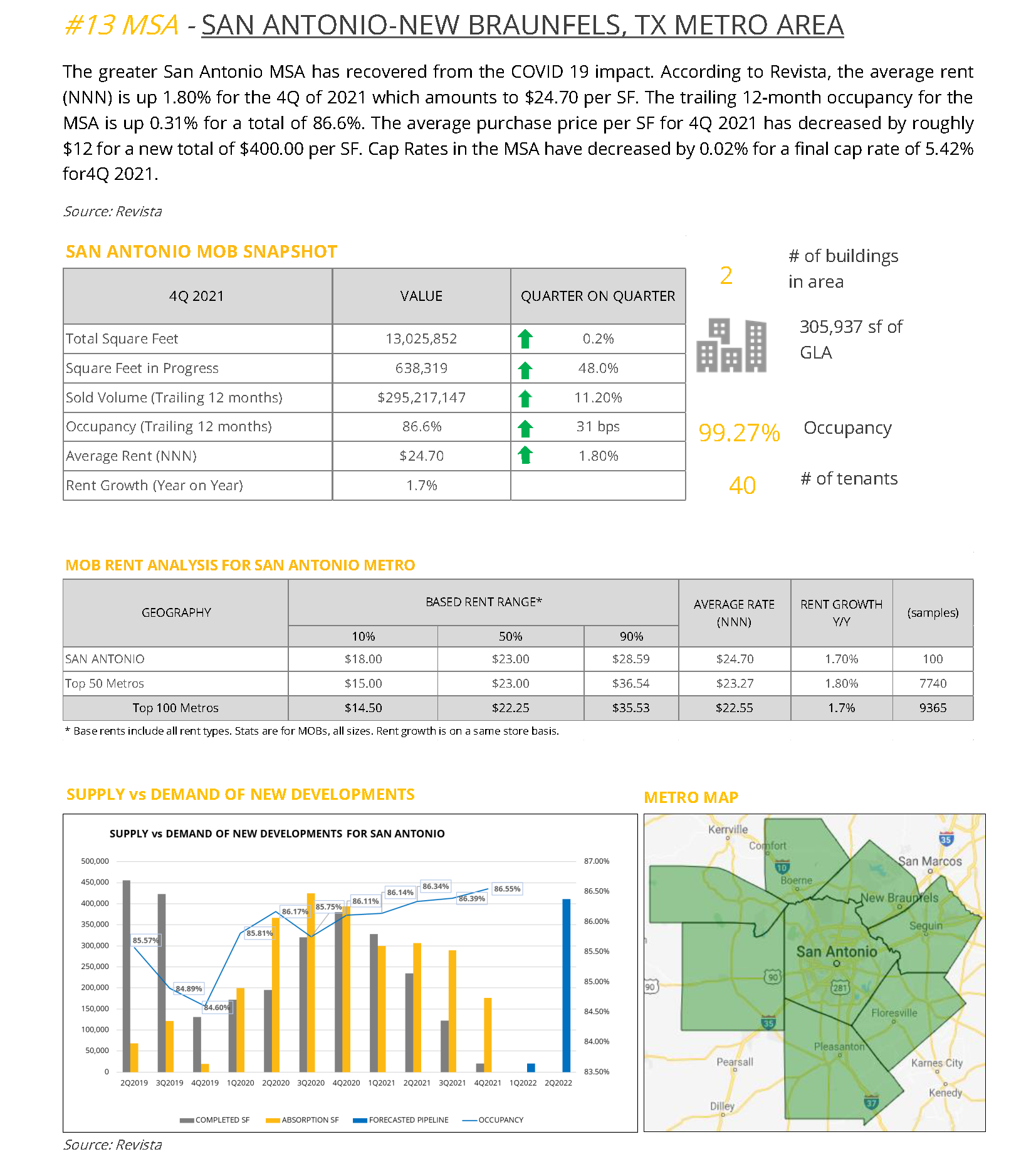

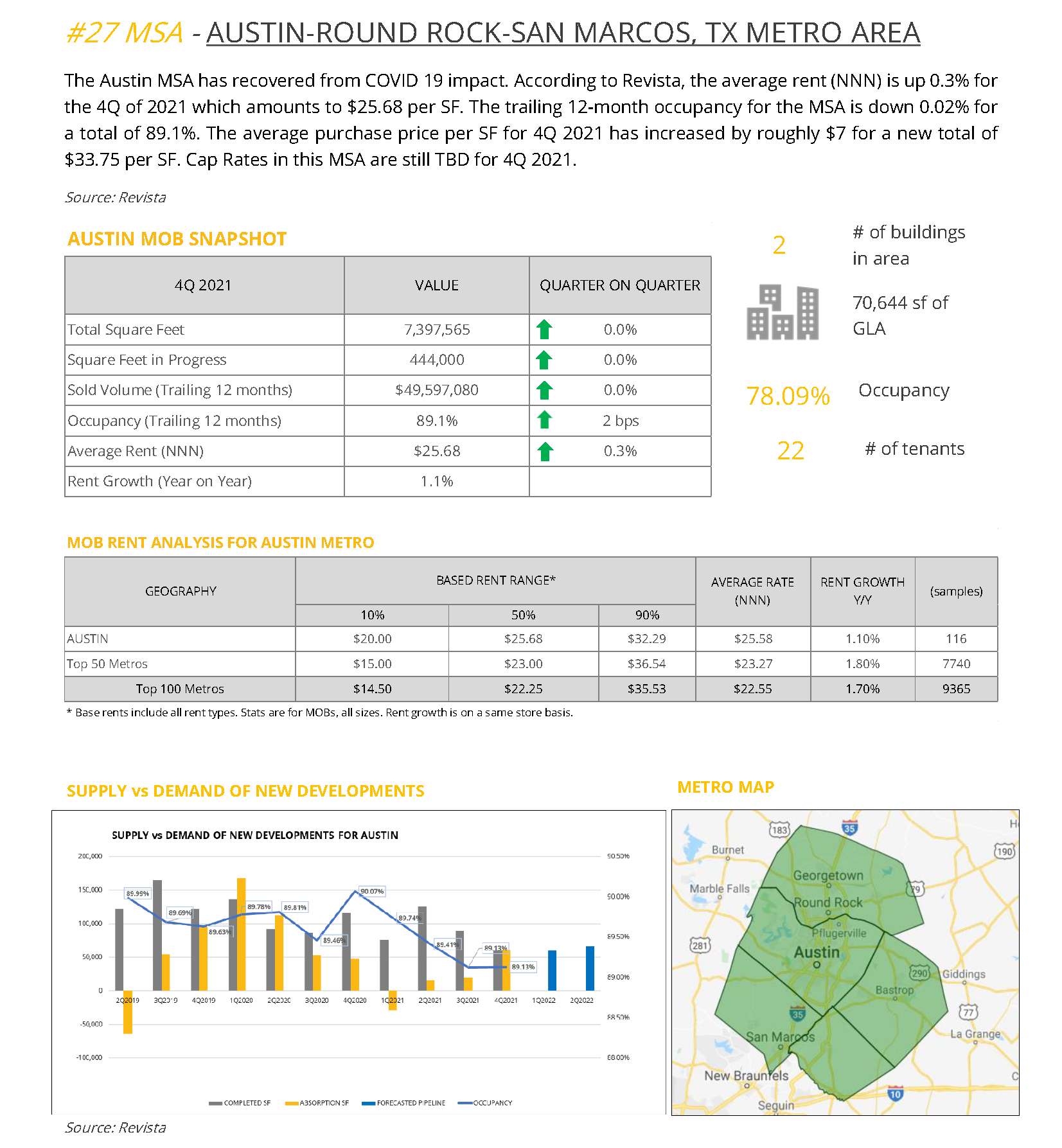

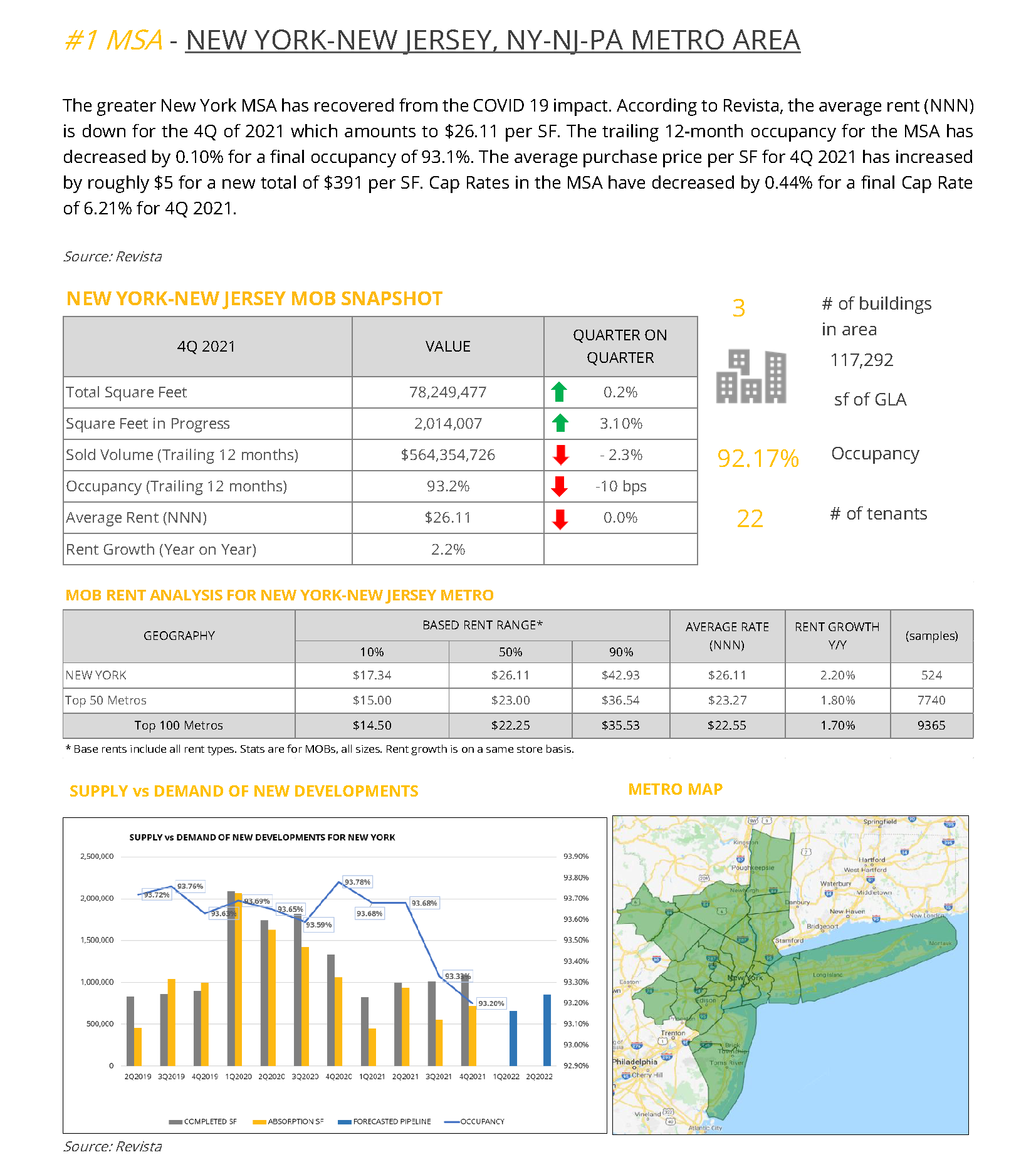

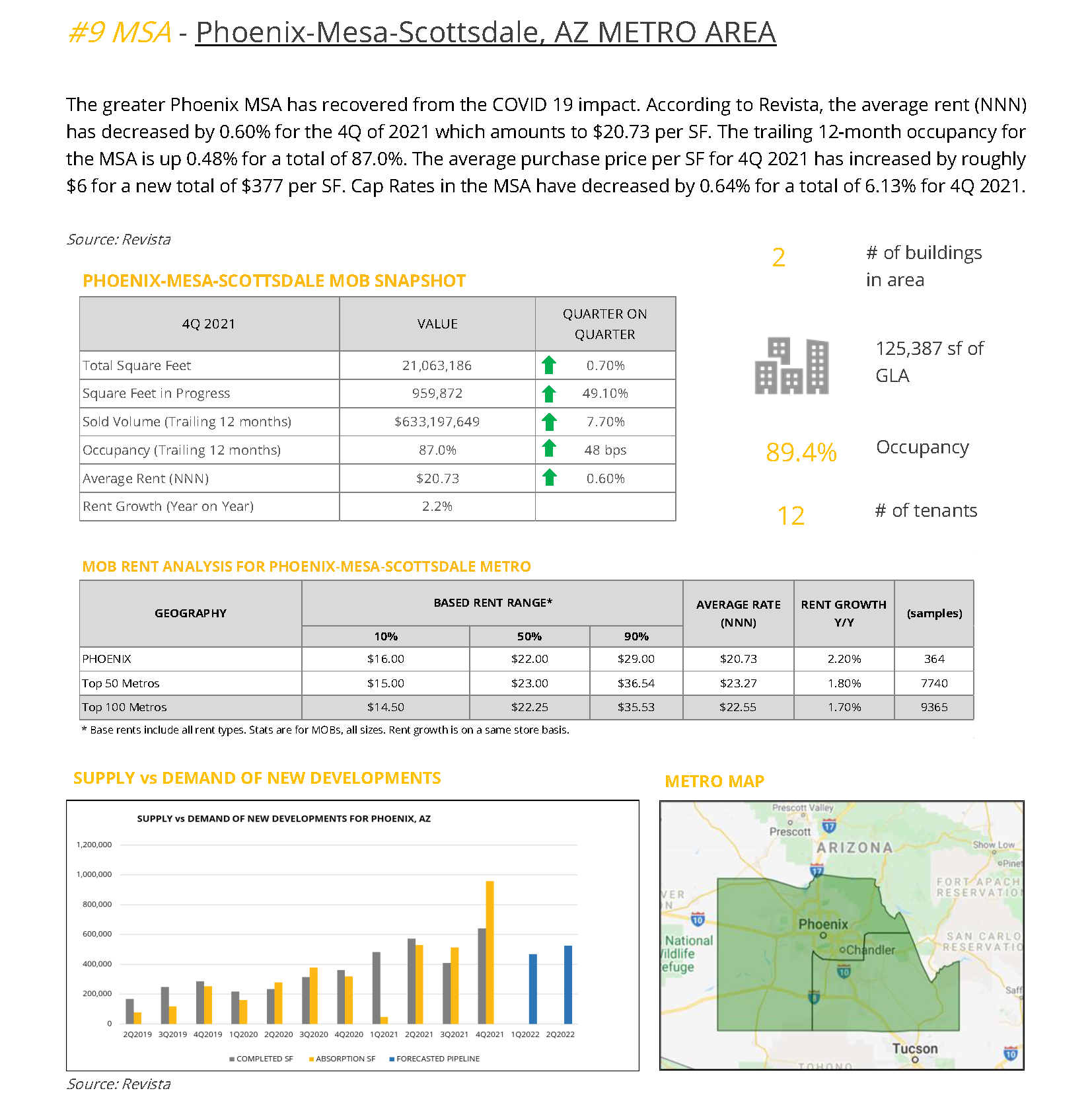

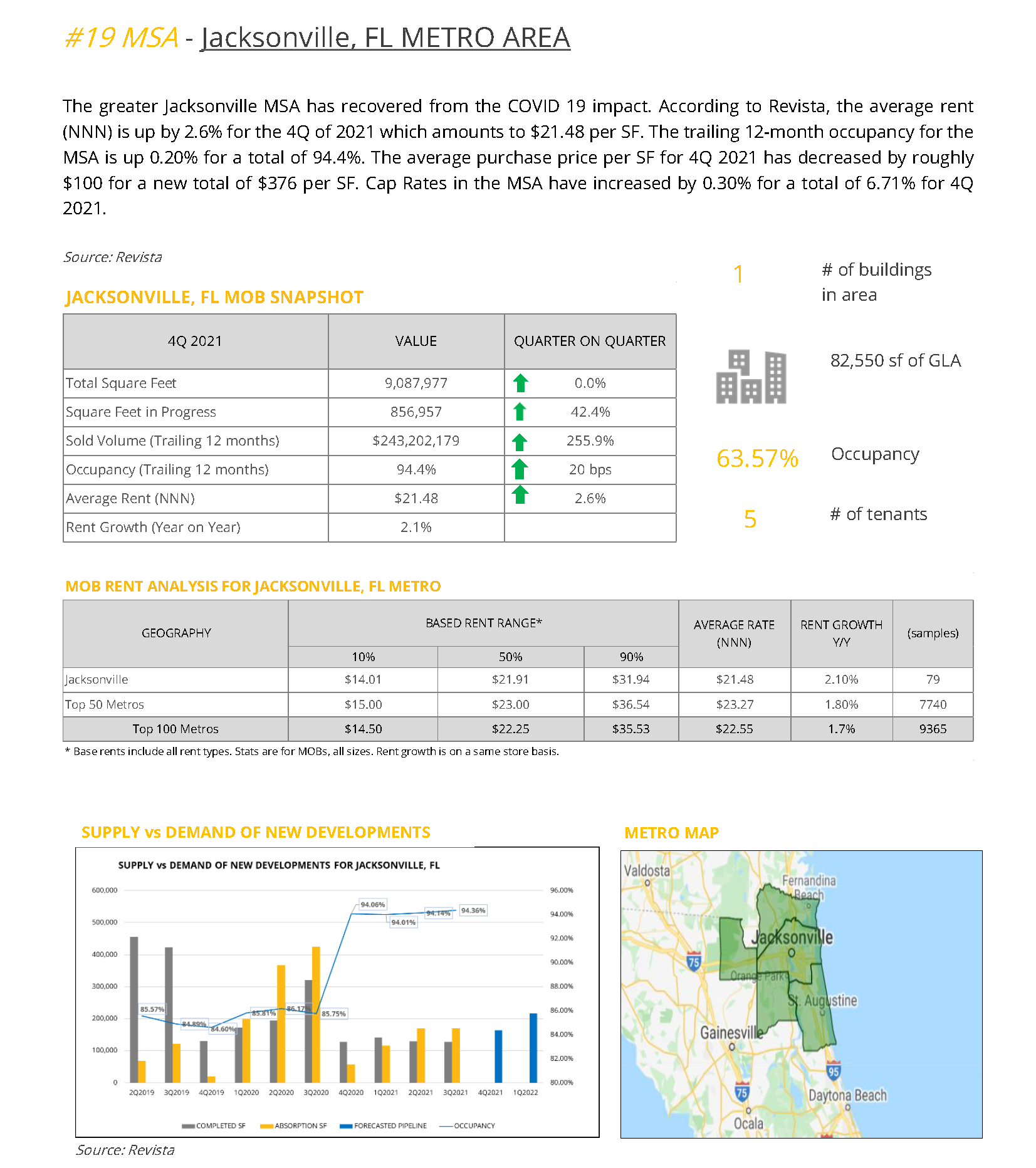

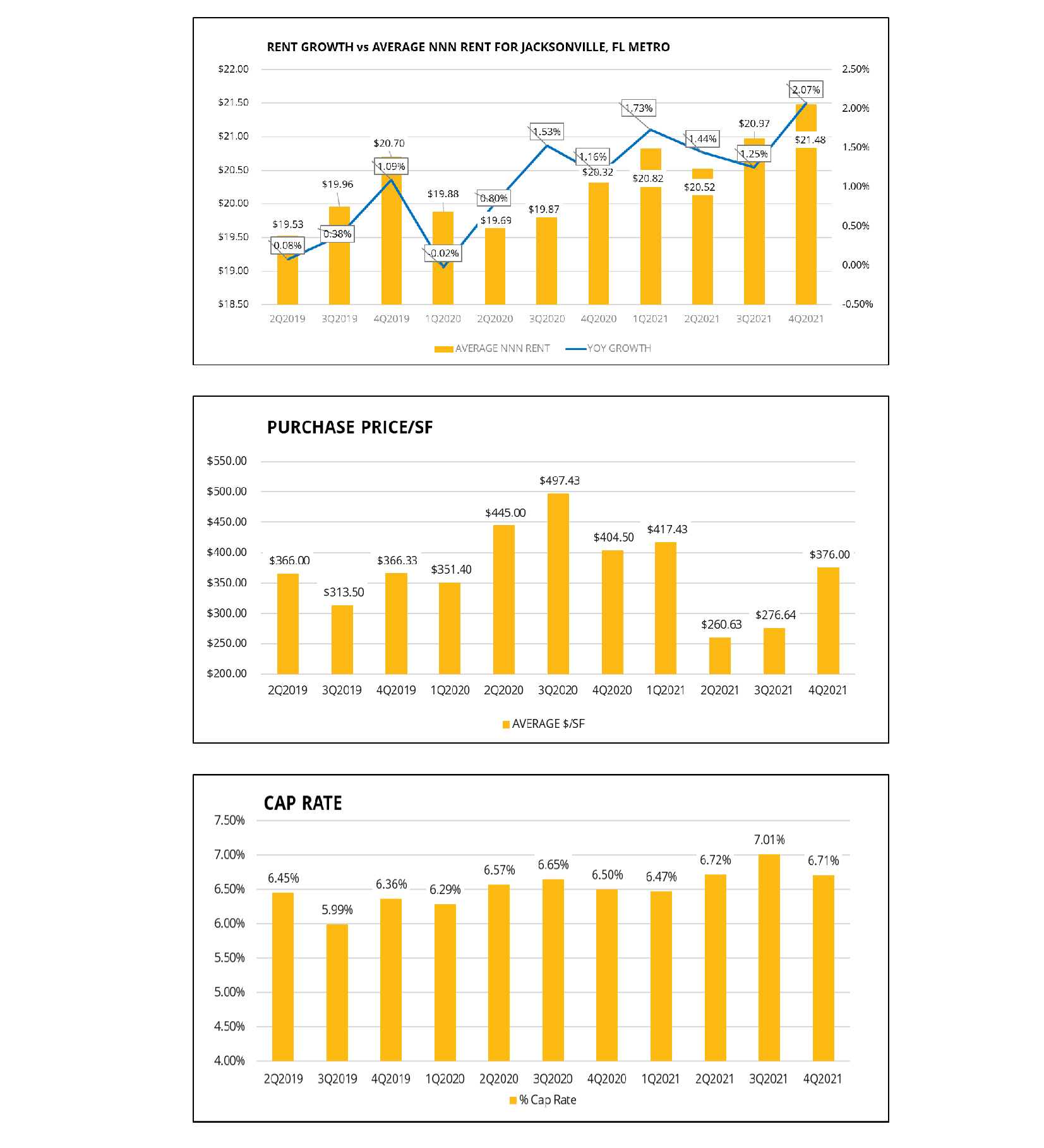

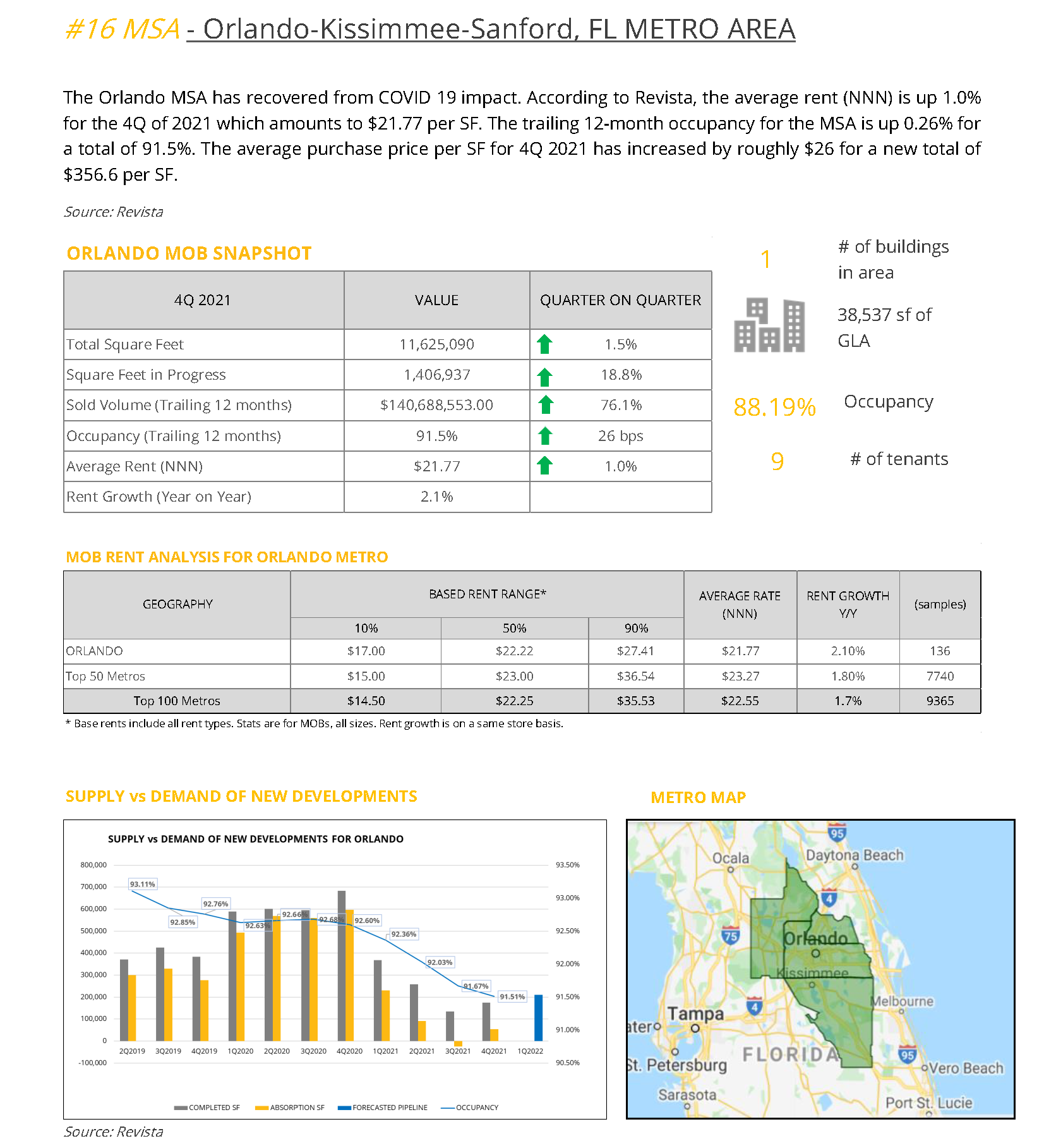

The 8 Metro reports from Revista, in which Orbvest is managing assets, have been added as a reference below. The data reflects the period of Q4 2021 that shows the recovery in the market post COVID-19. As can be seen below, the impact of COVID-19 reflects differently in each Metro.

DISCLAIMER

The content and information herein contained and being distributed by Orbvest are for information purposes only and should not be construed, under any circumstances, by implication or otherwise, as advice of any kind or nature, or as an offer to sell or a solicitation to buy or sell or to invest in any securities or currencies herein named. The information was obtained from sources believed to be reliable but is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. Past performance does not guarantee future performance.

Any market data or information used herein is for illustrative and informational purposes only. Please get the advice of a competent advisor before investing your money in any financial instrument or product and it is your responsibility to obtain the necessary legal, tax, investment, financial or any other type of advice in this regard.

Sources: REVISTA, WALL STREET JOURNAL, AVISON YOUNG RESEARCH, BLOOMBERG, DALLASFED.ORG AND U.S. BUREAU OF LABOR STATISTICS LATEST NUMBERS.