MARKET UPDATE - 2022 Q1

MARKET TRENDS - U.S. ECONOMY OUTLOOK

The US economy’s performance in the past few months has been better than most expected. While Omicron took infection rates to a new high, little trace appeared in economic data. Inflation and related problems, such as tangled supply chains, may continue to challenge business leaders and policymakers, but the economy is performing well by most measures. The unemployment rate has decreased and is back to its pre-pandemic level. The labor force participation rate has started to pick up, as some of the people who left the labor force are coming back to work. Corporate profits are more than satisfactory. Profits in Q3 2021 were 21% above the pre-pandemic level. That’s much better than many businesses had reason to expect when the pandemic first hit in March 2020.

Source: Deloitte Analysis

INTEREST RATES & INFLATION IN THE U.S.

The US Federal Reserve (Fed’s) actions have played a crucial role in response to the pandemic. When the virus first began spreading, there was a significant possibility that a financial market meltdown would exacerbate the country’s economic problems. The Fed’s prompt and strong actions kept financial markets liquid and operating, preventing those additional problems. With GDP now above the pre-pandemic level, strong employment growth, and some signs of early inflation, the Fed has started to unwind its pandemic response. Tapering purchases of long-term assets began after the early November 2021 FOMC meeting and are set to finish at the March 2022 meeting. That would be a fast reversal of the policy. The end of quantitative easing, however, will not end questions about the Fed’s policy. It will still own more than US$7 trillion in long-term assets (both Treasuries and mortgage-backed securities). The Fed may eventually actively sell these, or it may elect to let them end by not replacing them as they mature. Discussions about the Fed balance sheet will continue for some time.

At the same time, the pressure on the Fed to begin raising the funds rate has intensified. In November 2021, Fed officials were suggesting that the first rate hike would occur in late 2022. By February, Fed watchers considered a hike at the March meeting very likely, and there was some discussion of a 50-basis-point hike to send a signal to markets. (The Fed normally raises the funds rate by about 25 basis points each time, so that the impact of higher interest rates occurs gradually.) The baseline forecast assumes that the Fed hikes the funds rate by 25 basis points at each of the three meetings in the spring of 2022 (March, May, and June), and continues to raise rates by 25 basis points at every other meeting after that. This is consistent with our assumption that inflation will decline in the second half of 2022, which would take a lot of pressure off the Fed. We expect the Fed will stop hiking when the funds rate is a bit above 2.5%, leaving real short-term interest rates in positive territory.

Economists expect long-term rates will rise as well, reflecting the global economic recovery and the rise in short-term rates. By 2026, the 10-year Treasury is forecast at 3.9%. That may seem high today, but is, in fact, low in the historical context. It would imply a spread between long- and short-term rates that is only about half the level the economy normally experiences in full employment. The possibility that, in a booming economy, long-term interest rates might rise by even more should not be dismissed. Of course, interest rates are always the least certain part of any forecast. Any significant news could, and will, alter interest rates significantly.

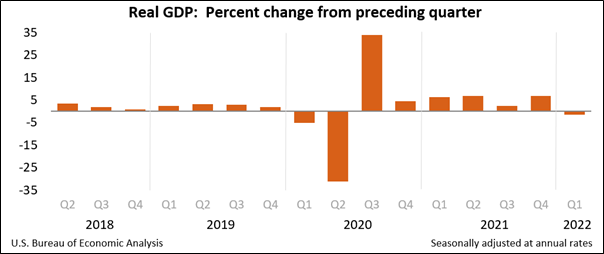

The US economy unexpectedly shrank at a 1.4 percent annualized rate in the first three months of 2022, after more than a year of rapid growth, according to a Bureau of Economic Analysis report. The new data is fueling concerns about a recession in the future amid steady inflationary pressures and uncertainty over the war in Ukraine. The slowdown — the first since the Covid-19 recession in April 2020 — marks a reversal from the rapid pace that followed intense fiscal and monetary stimulus in the wake of the pandemic. Last year, for example, the US economy grew by 5.7 percent, its fastest full-year rate since 1984.

While most economists still believe the expansion has plenty of momentum, particularly given the strength of the job market, recession fears have been rising, as inflation shows little signs of easing. The weakness comes amid worrisome signs that some of the world’s largest economies, including China and Europe, are grinding to a standstill. For example, the International Monetary Fund recently slashed estimates for global economic growth. Still, many parts of the economy remain robust. Employers have created more than 400,000 jobs for 11 straight months, sending the unemployment rate to a new pandemic low and near a multi-decade low. And despite higher costs, families and businesses are continuing to spend and invest.

Source: US Bureau of Economic Analysis

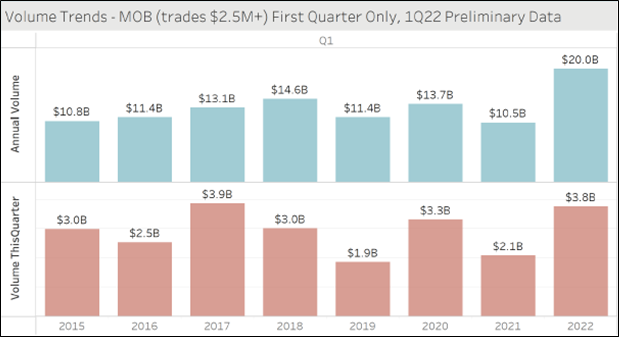

Source: Revista

The chart above shows that since Q1 2021, medical office sales volumes have increased significantly. We believe that this trend will continue into 2022. This increase over the past four quarters is roughly 47%. As the US economy becomes more stable, we believe that this sales volume will continue to increase as we move further into 2022.

The chart above shows that cap rates in the US for medical offices have continued to compress since the beginning of Q1 2021. We believe that this trend will continue into 2022. For median cap rates, the medical office industry saw a 0.3% decrease, from 6% to 5.7%. We believe that cap rates for medical offices will continue to stay low as it is a desired and resilient commercial real estate asset.

CONCLUSION

The medical office real estate sector has shown overall steady growth as well as a marked turnaround in the submarket in which OrbVest has investments. Refer to the detailed submarket review below. The healthcare commercial real estate niche has survived well through the pandemic and is stabilized and growing. Data shows that US healthcare commercial real estate will be in demand in the future.

MARKET DATA - REFERENCE

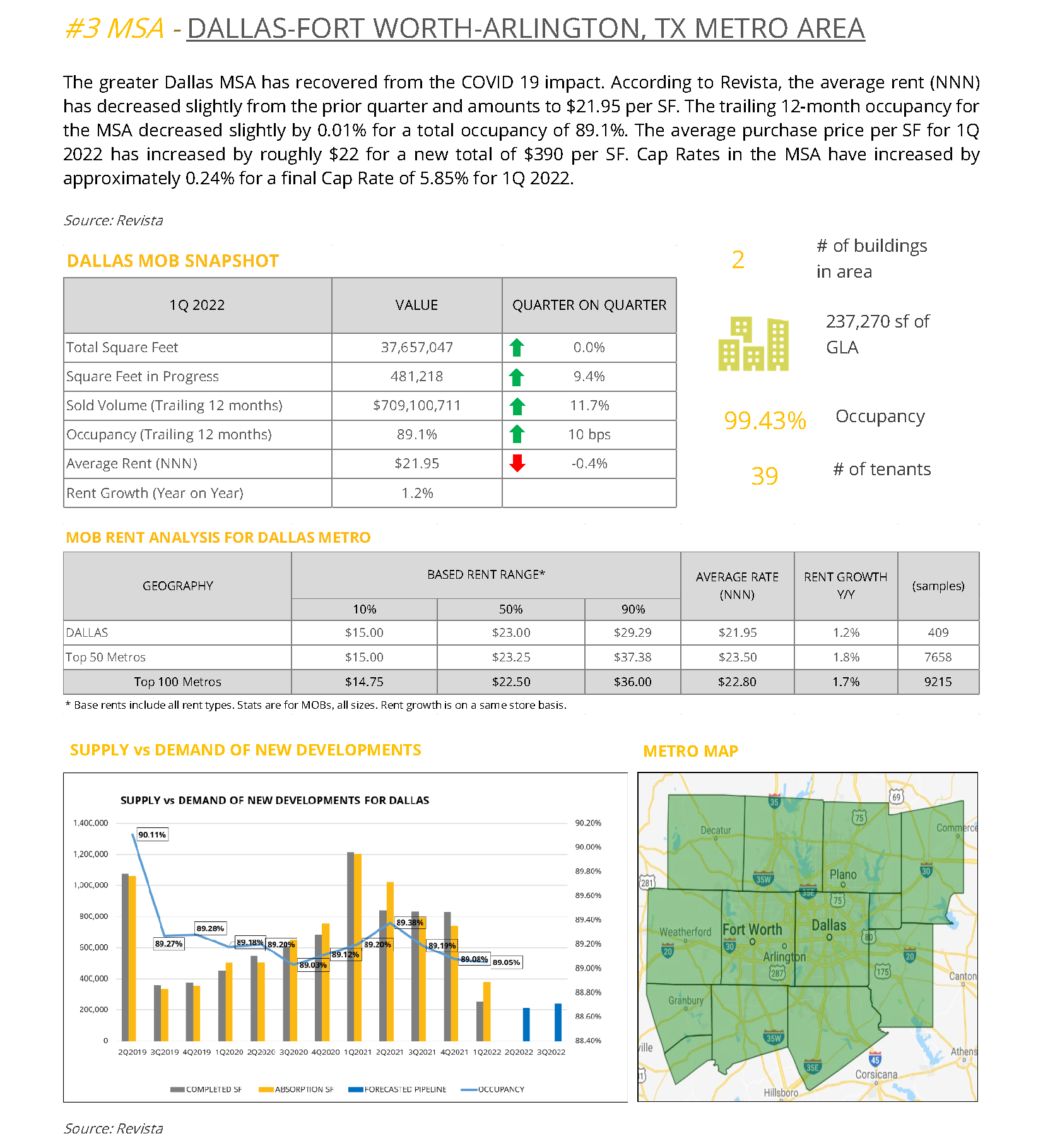

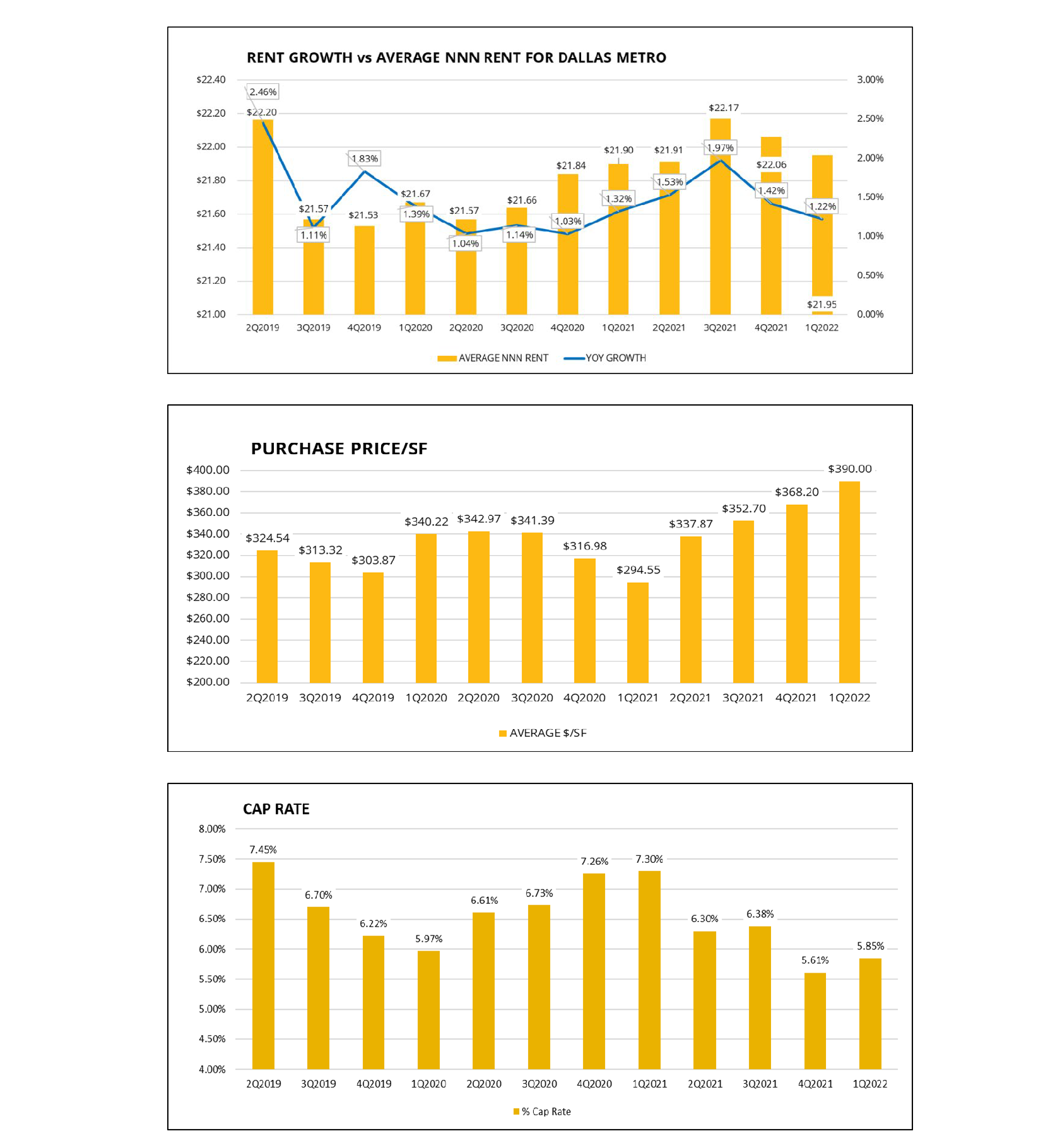

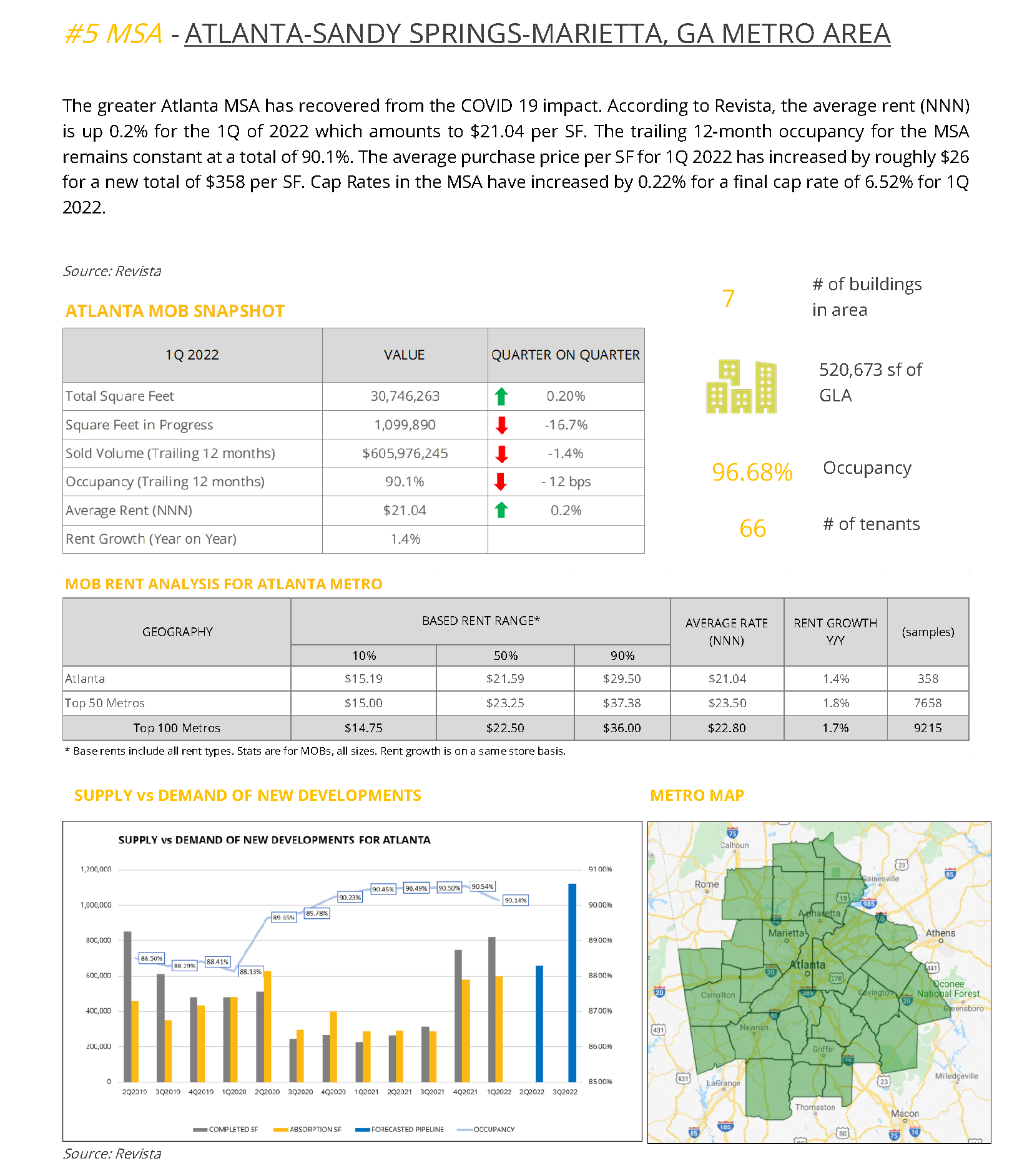

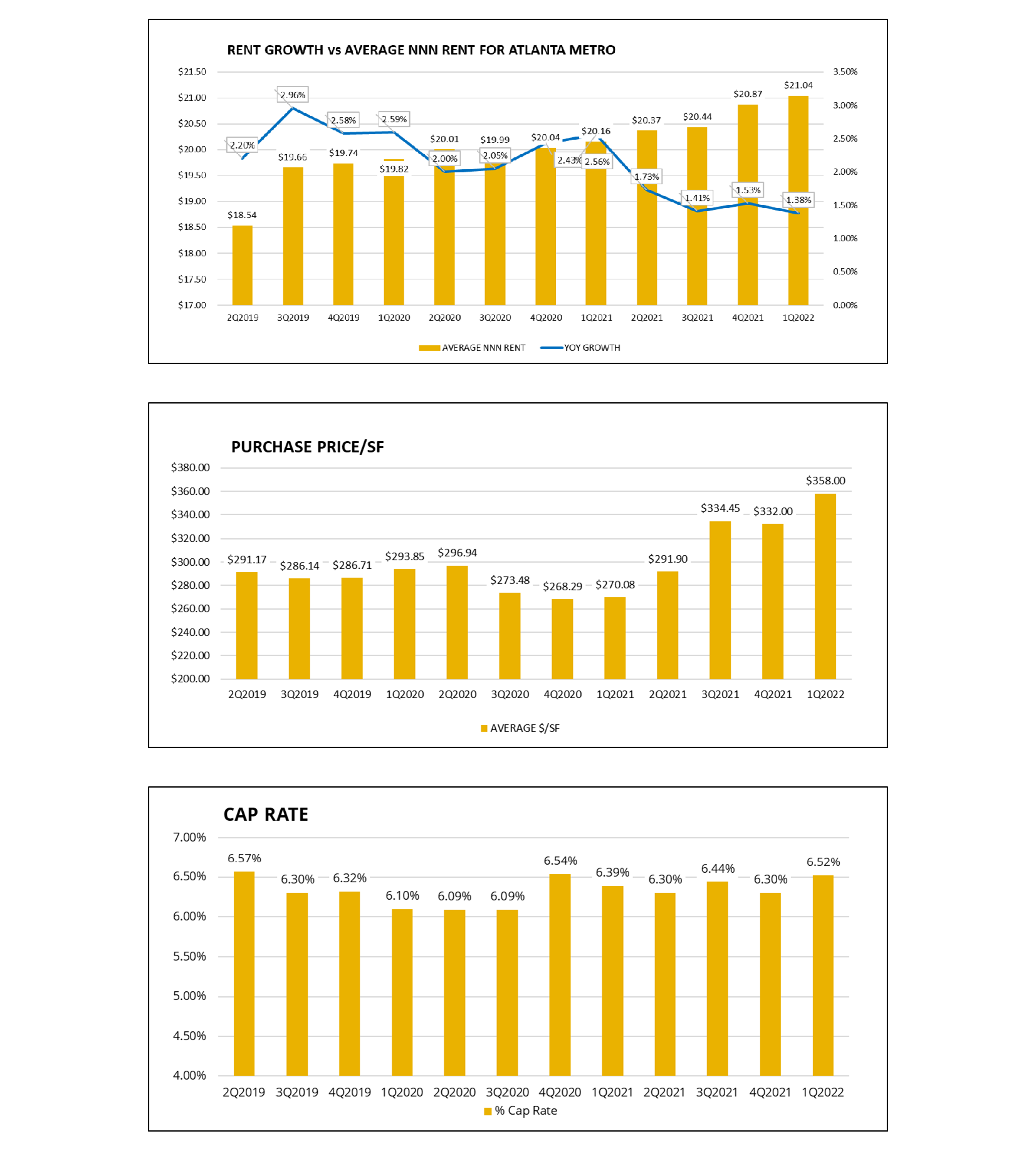

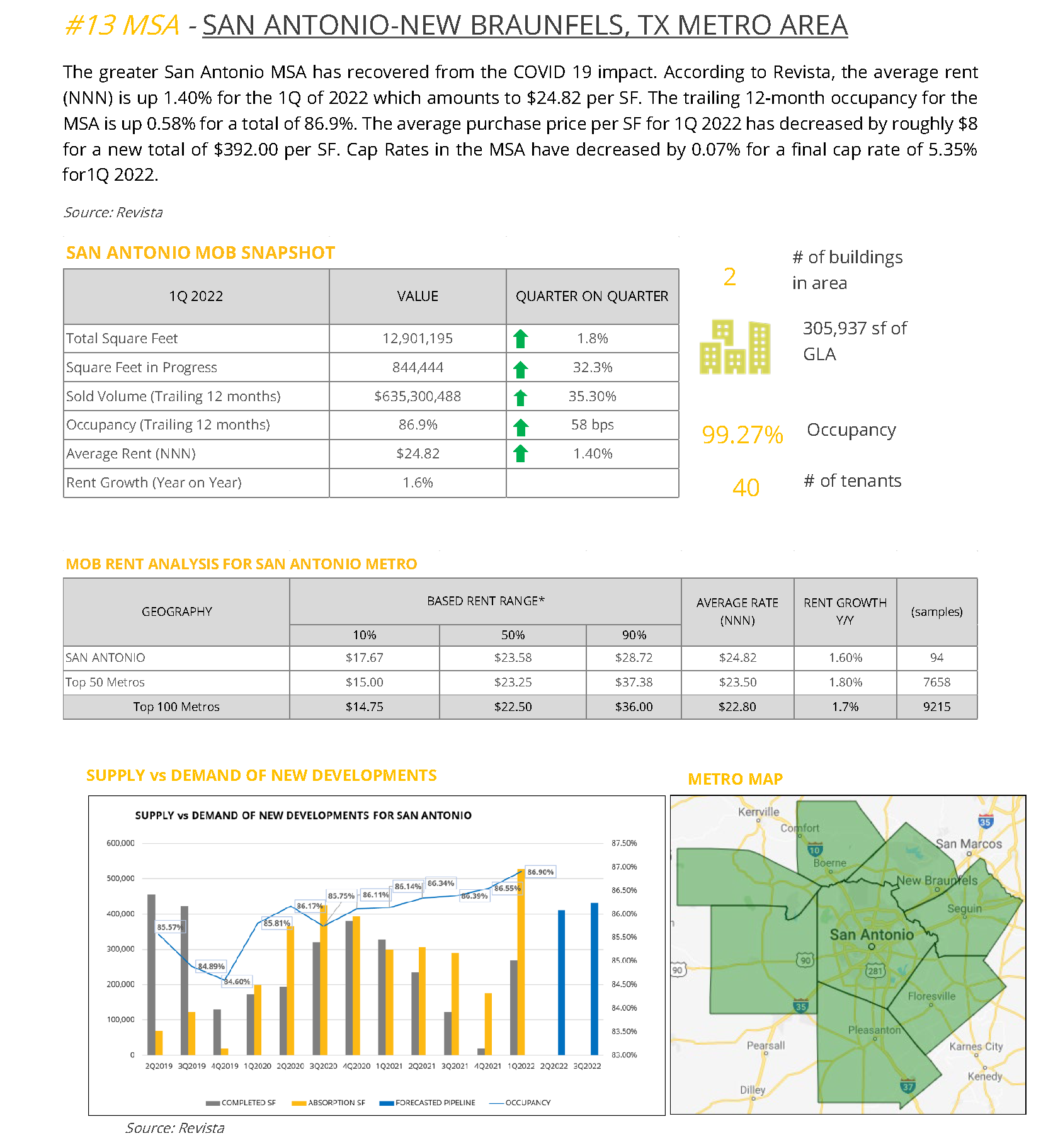

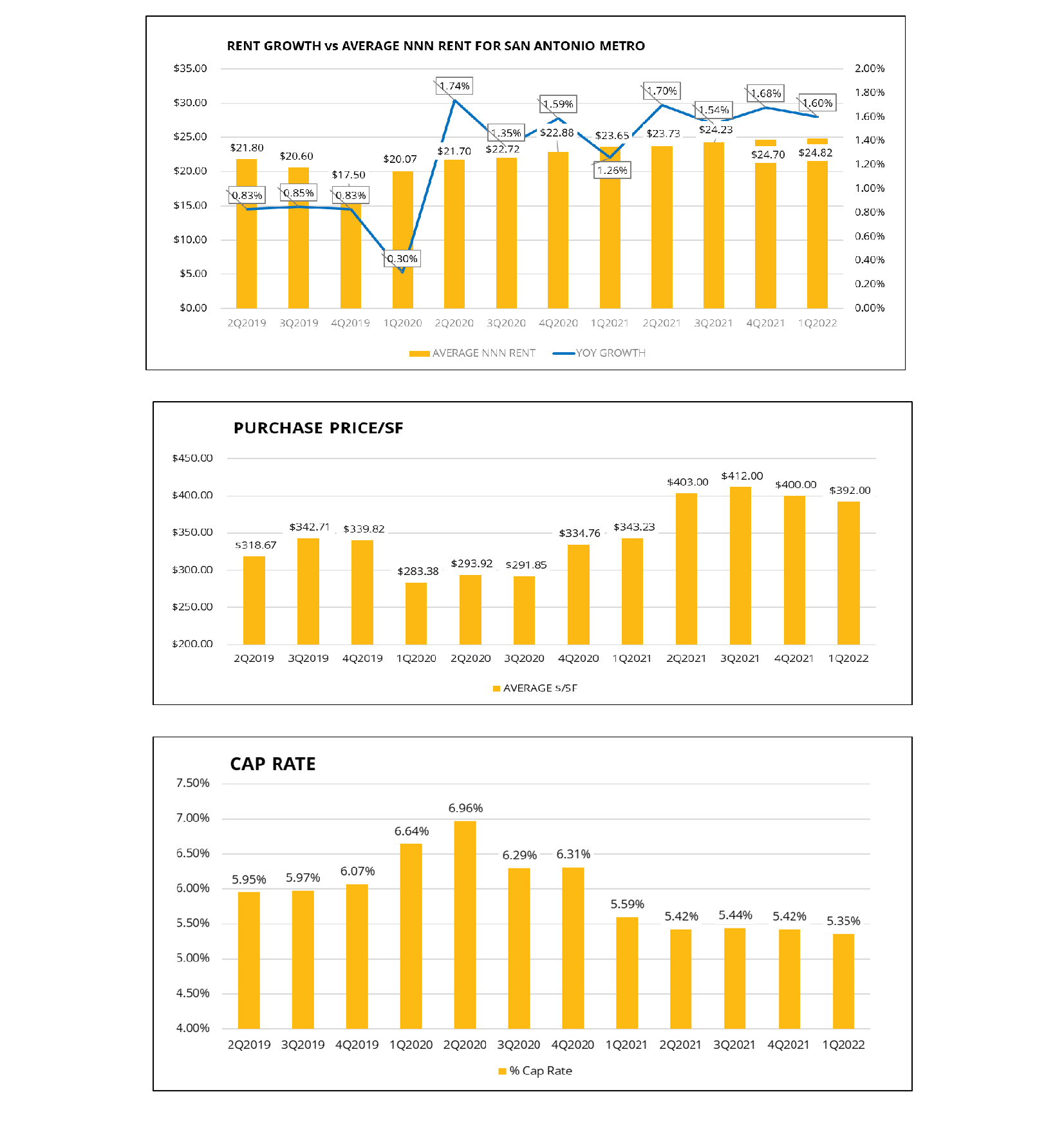

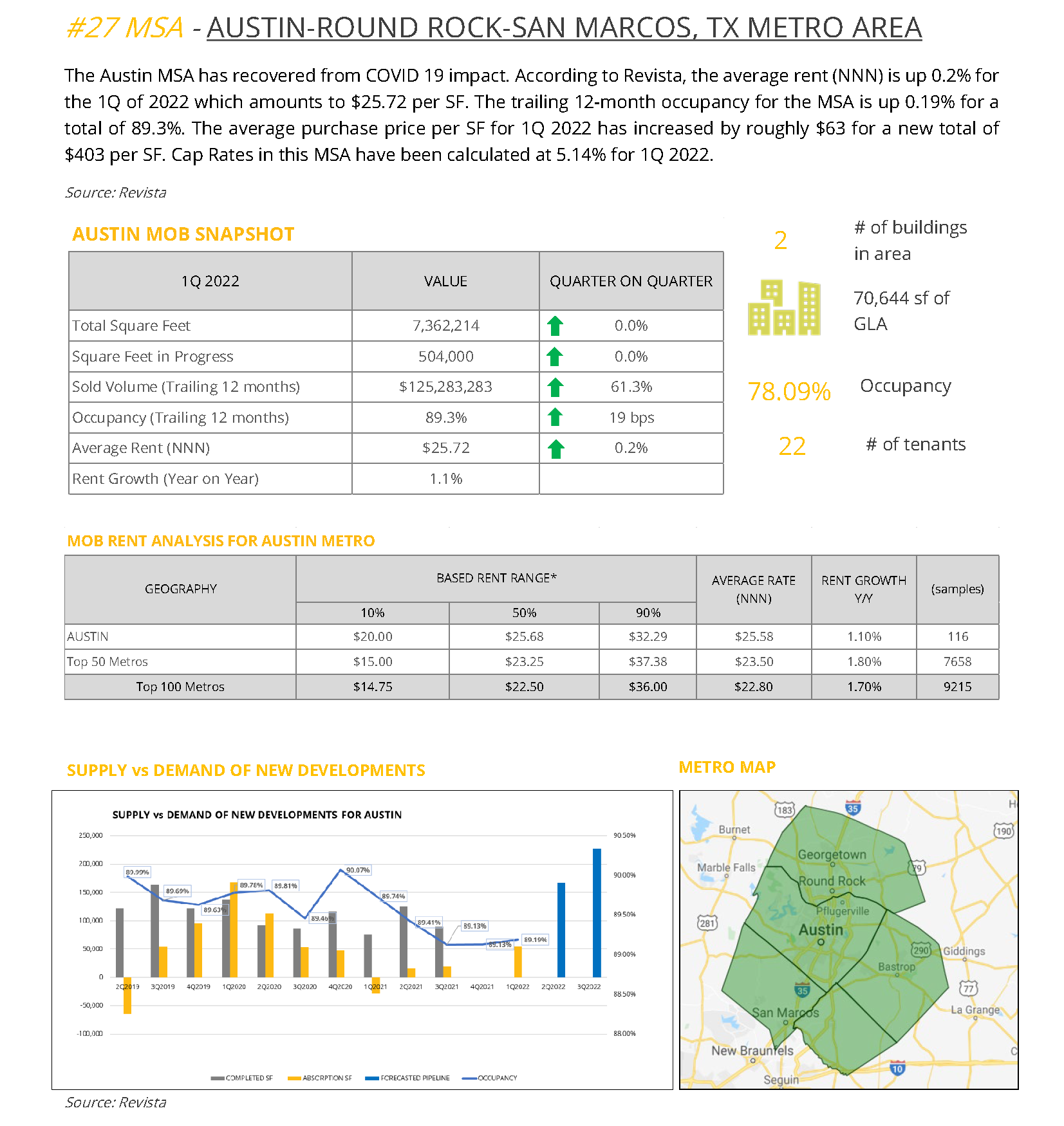

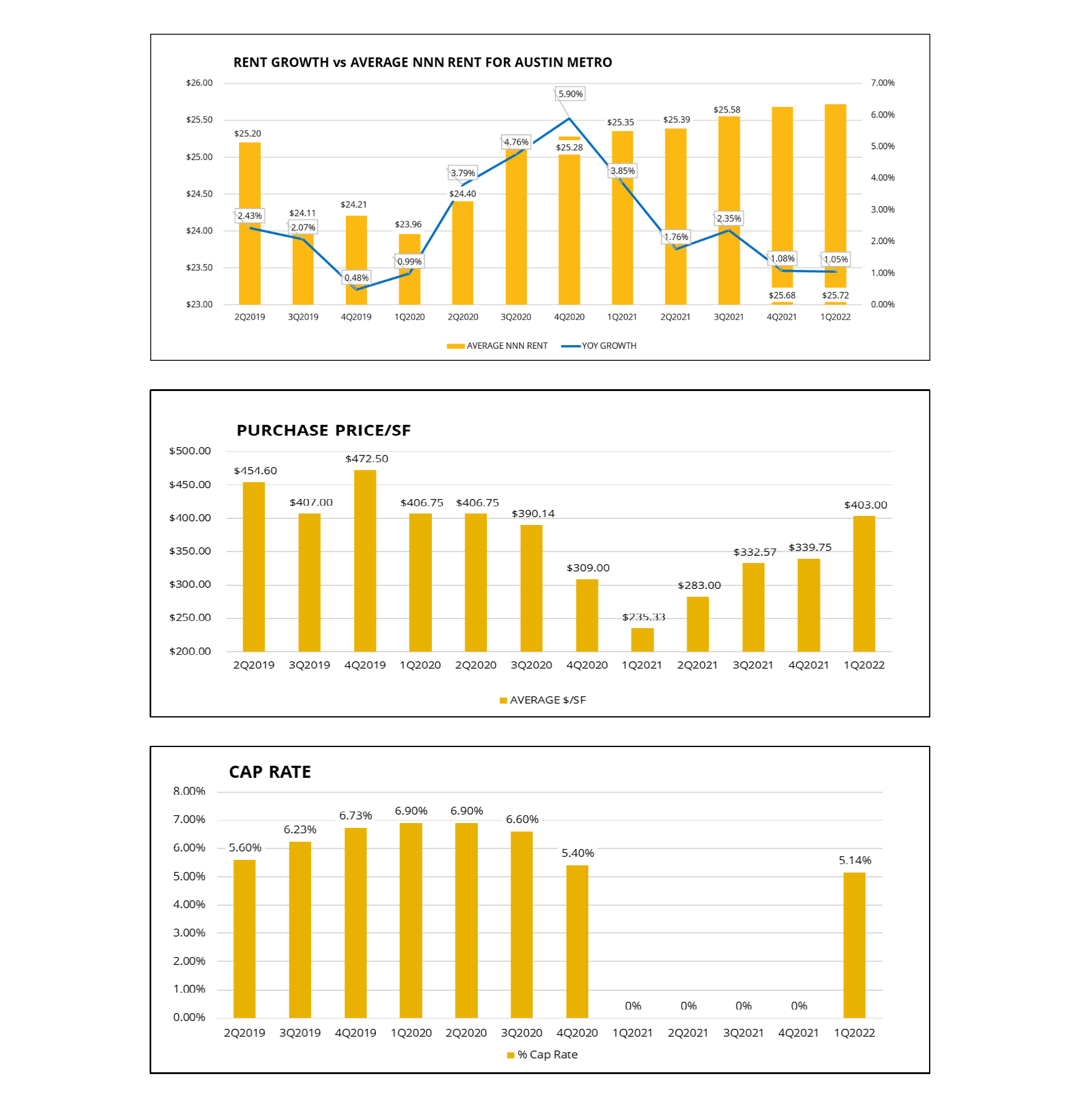

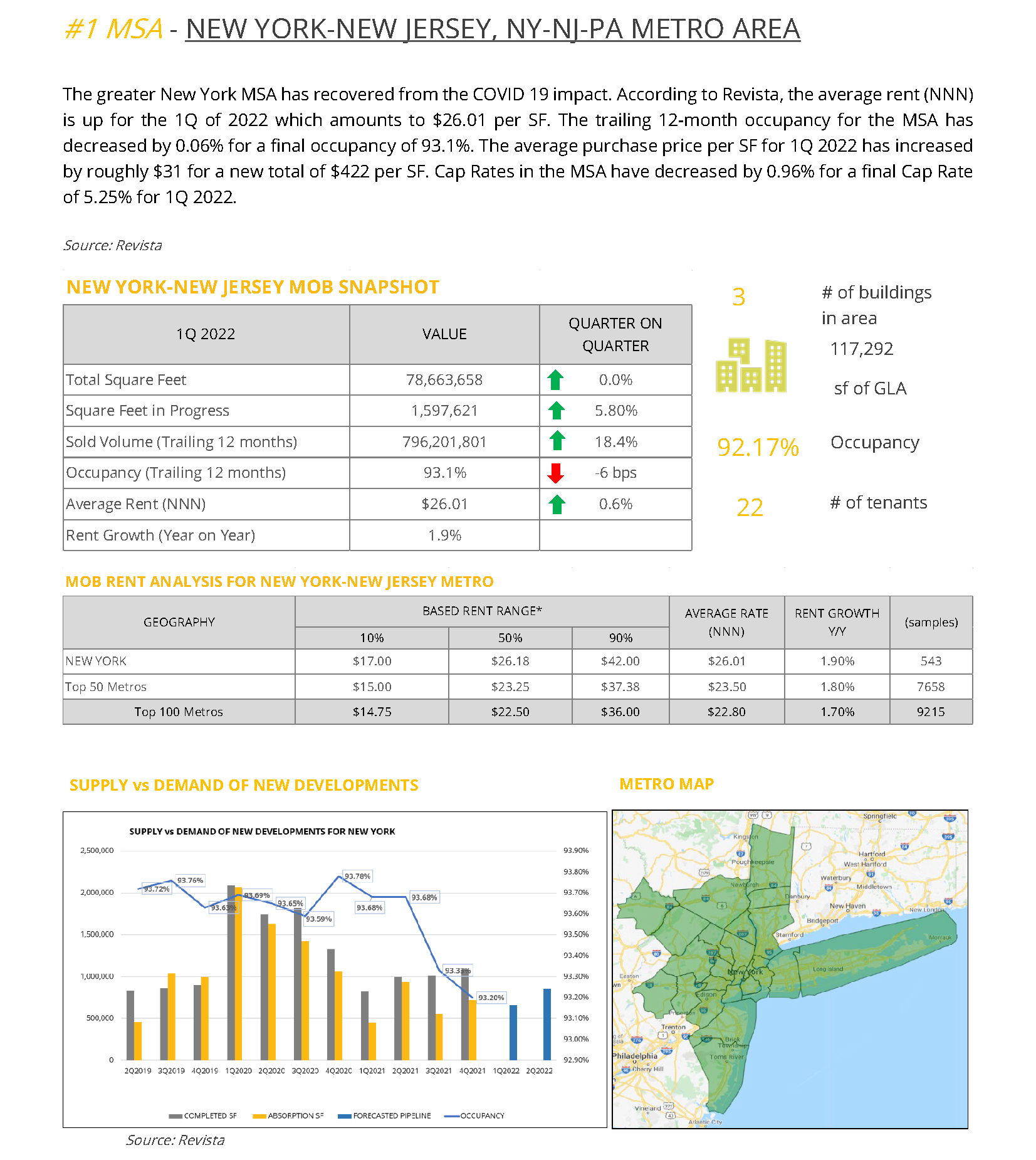

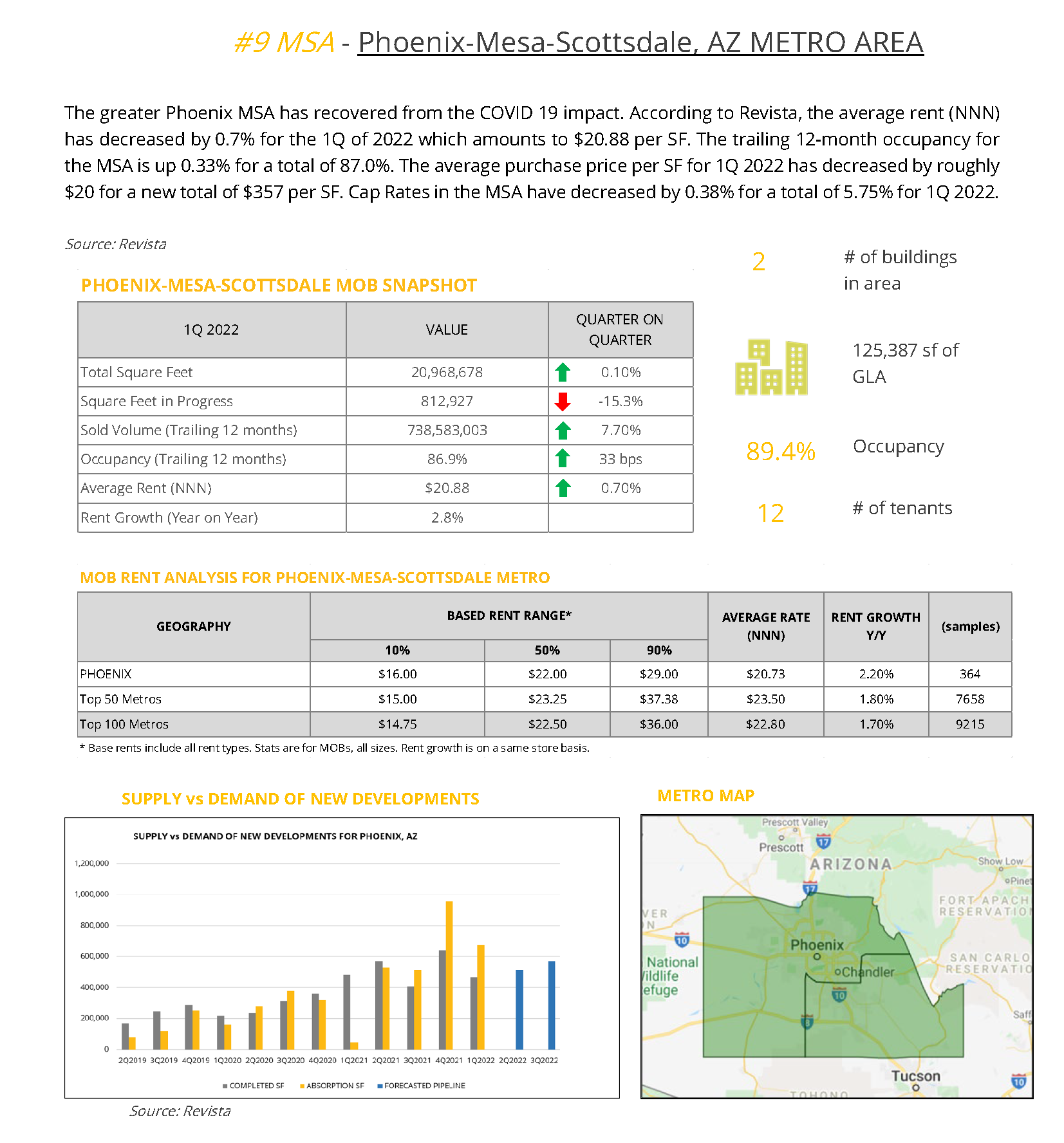

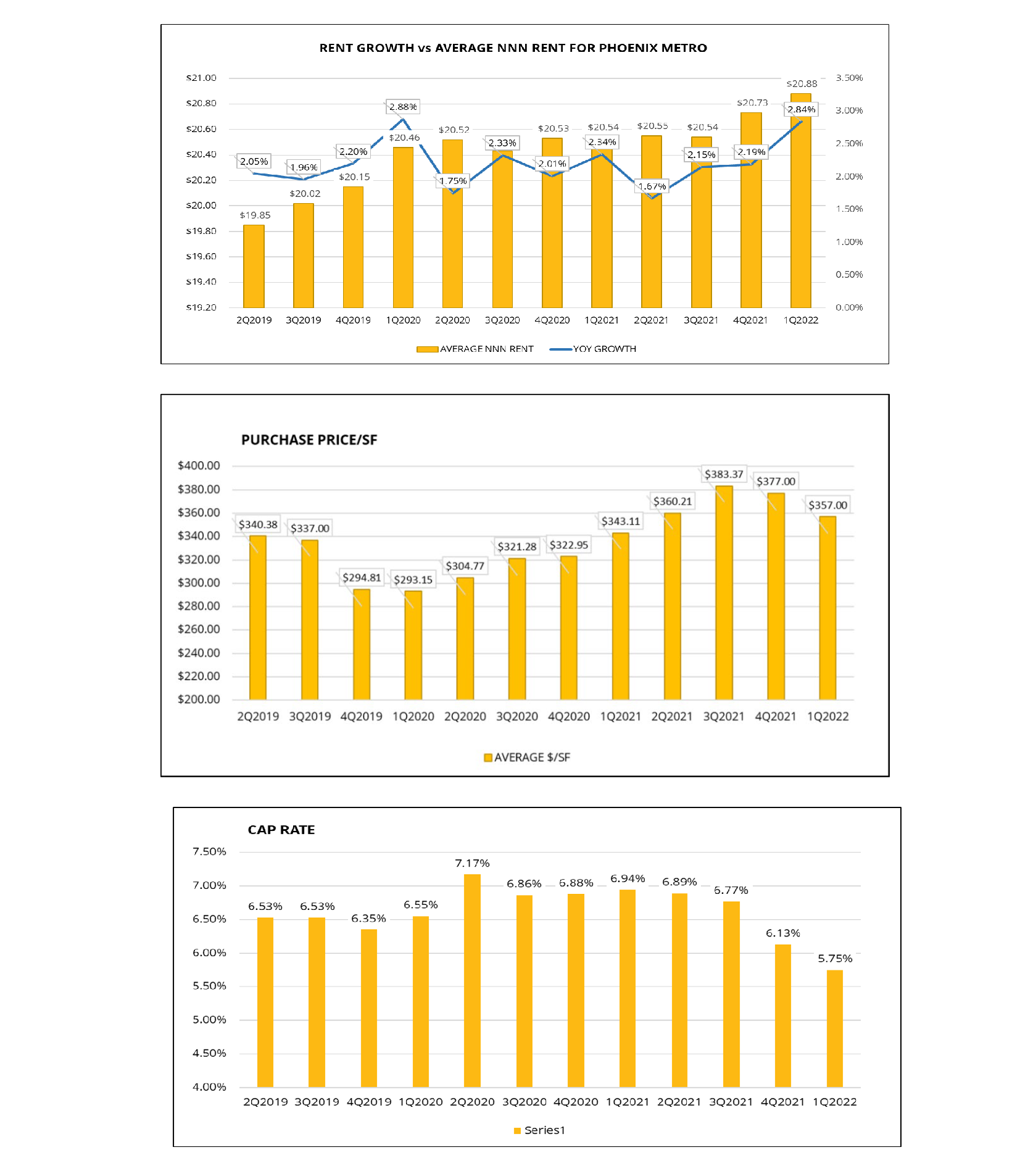

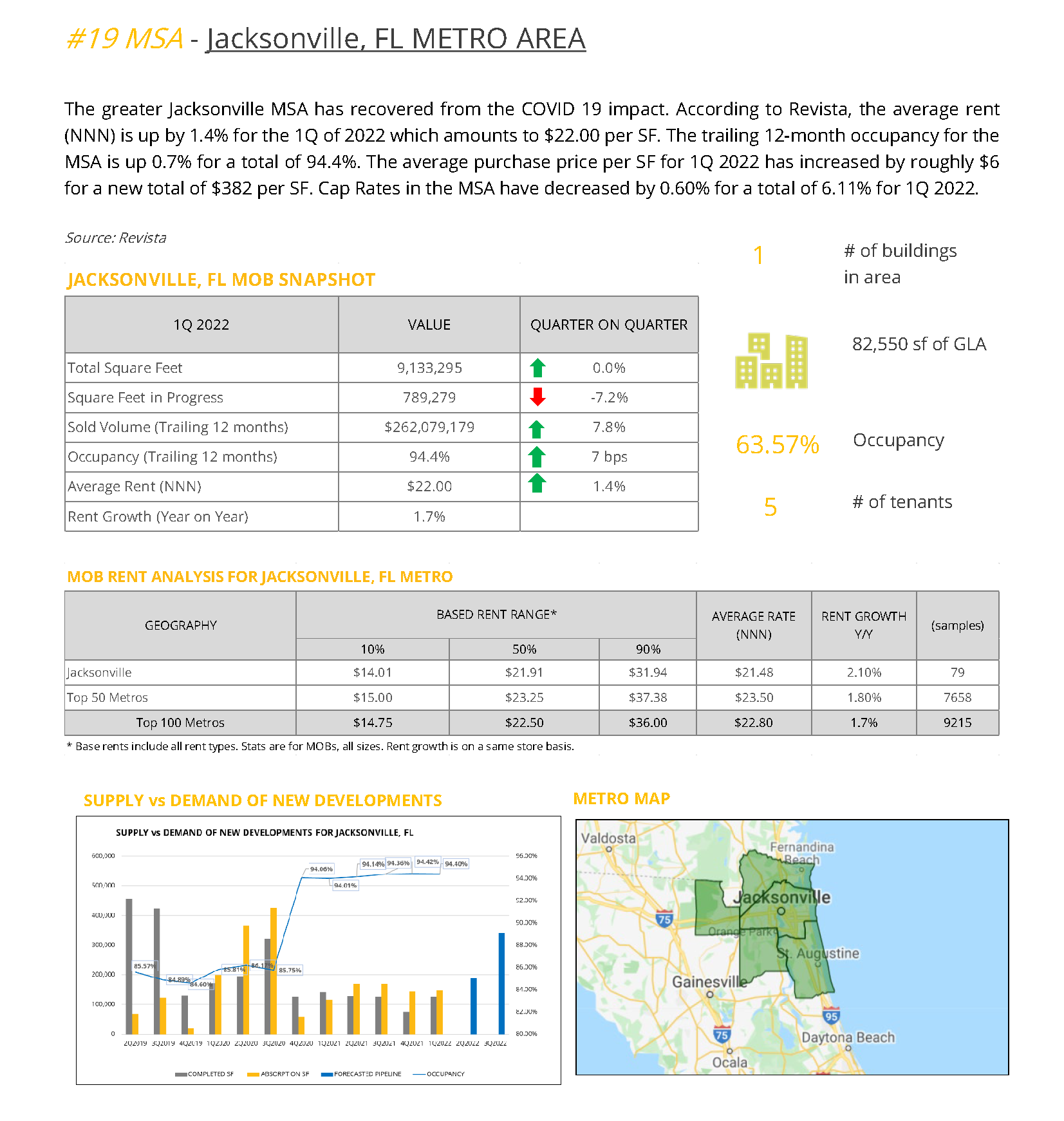

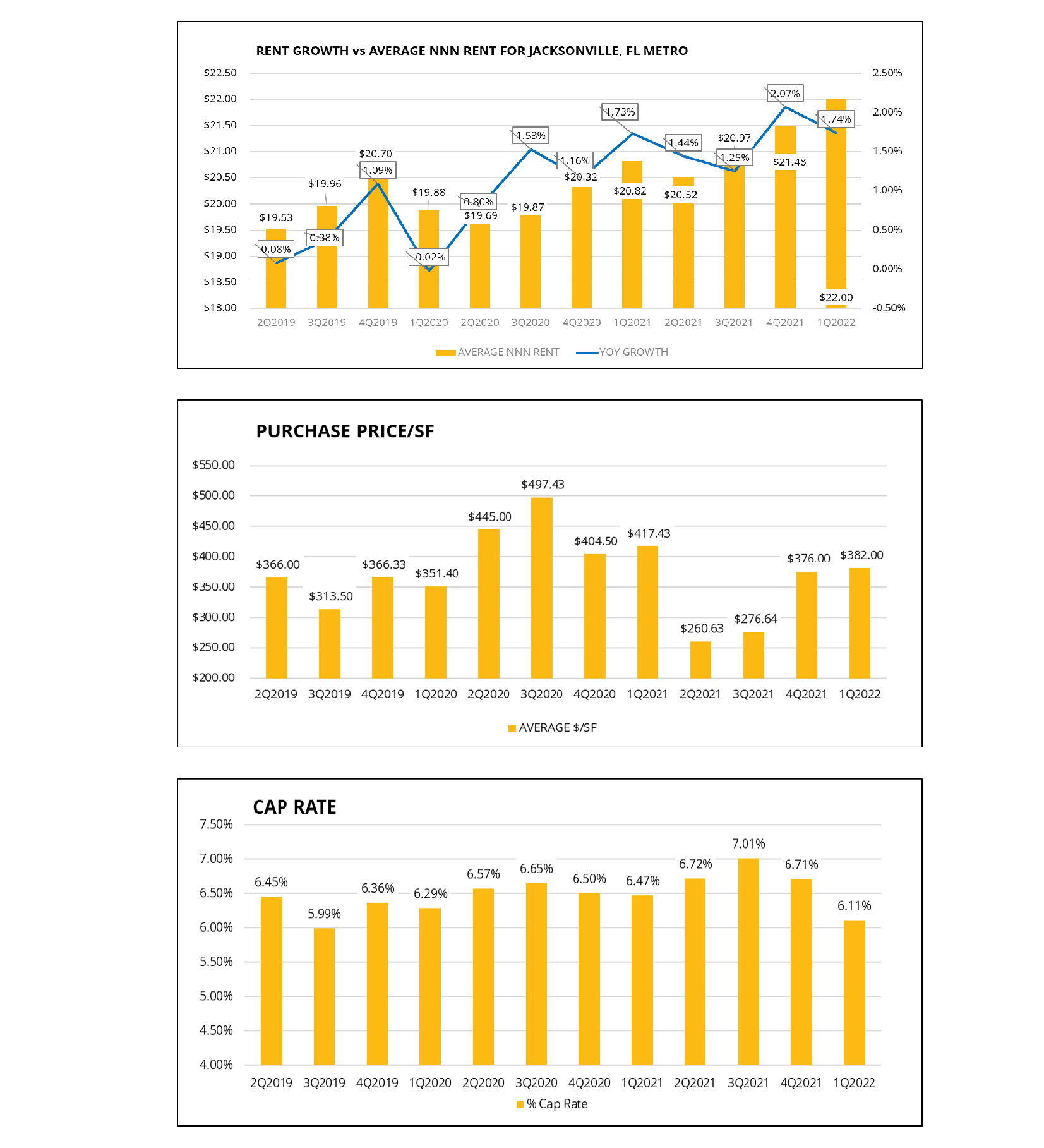

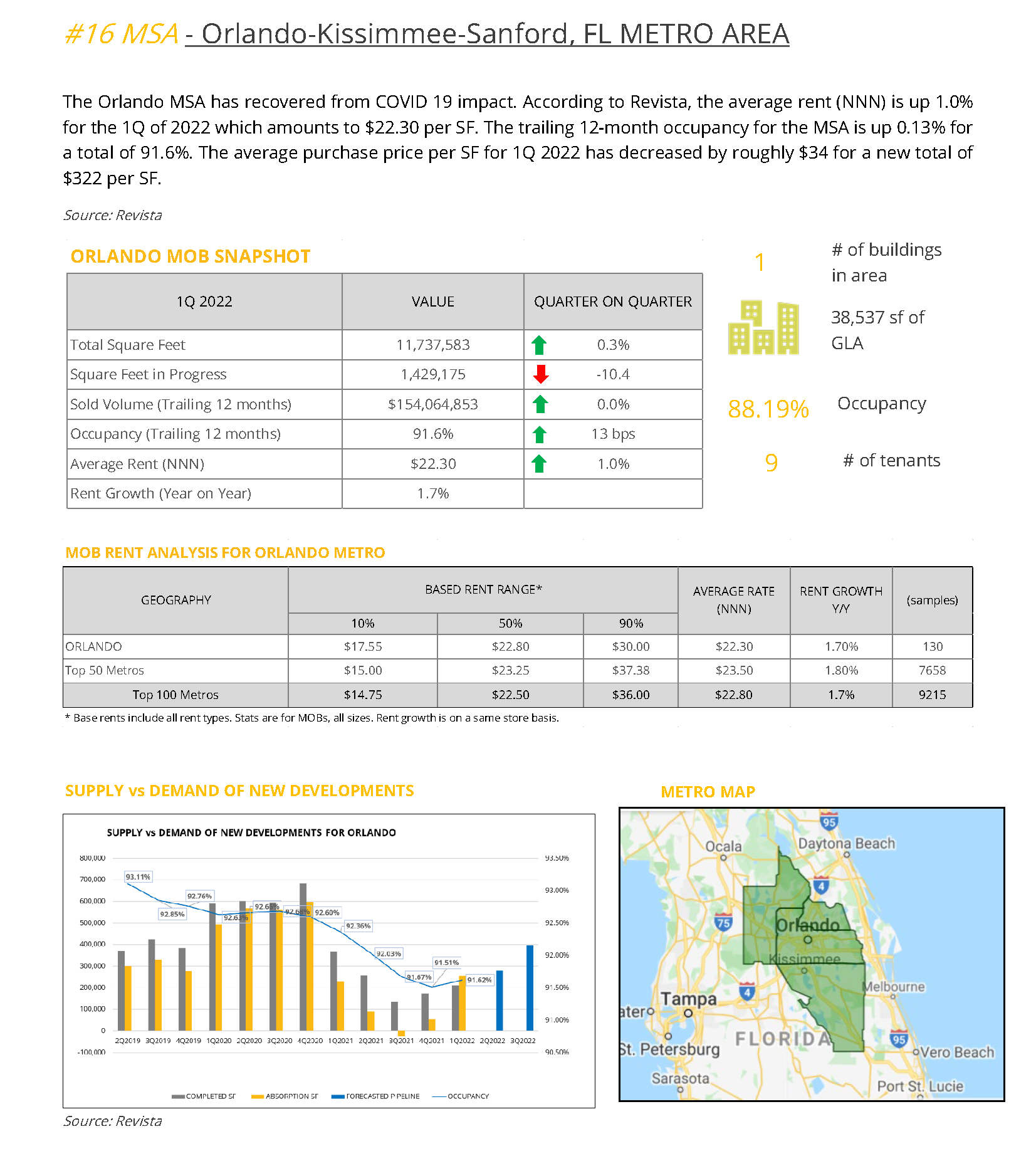

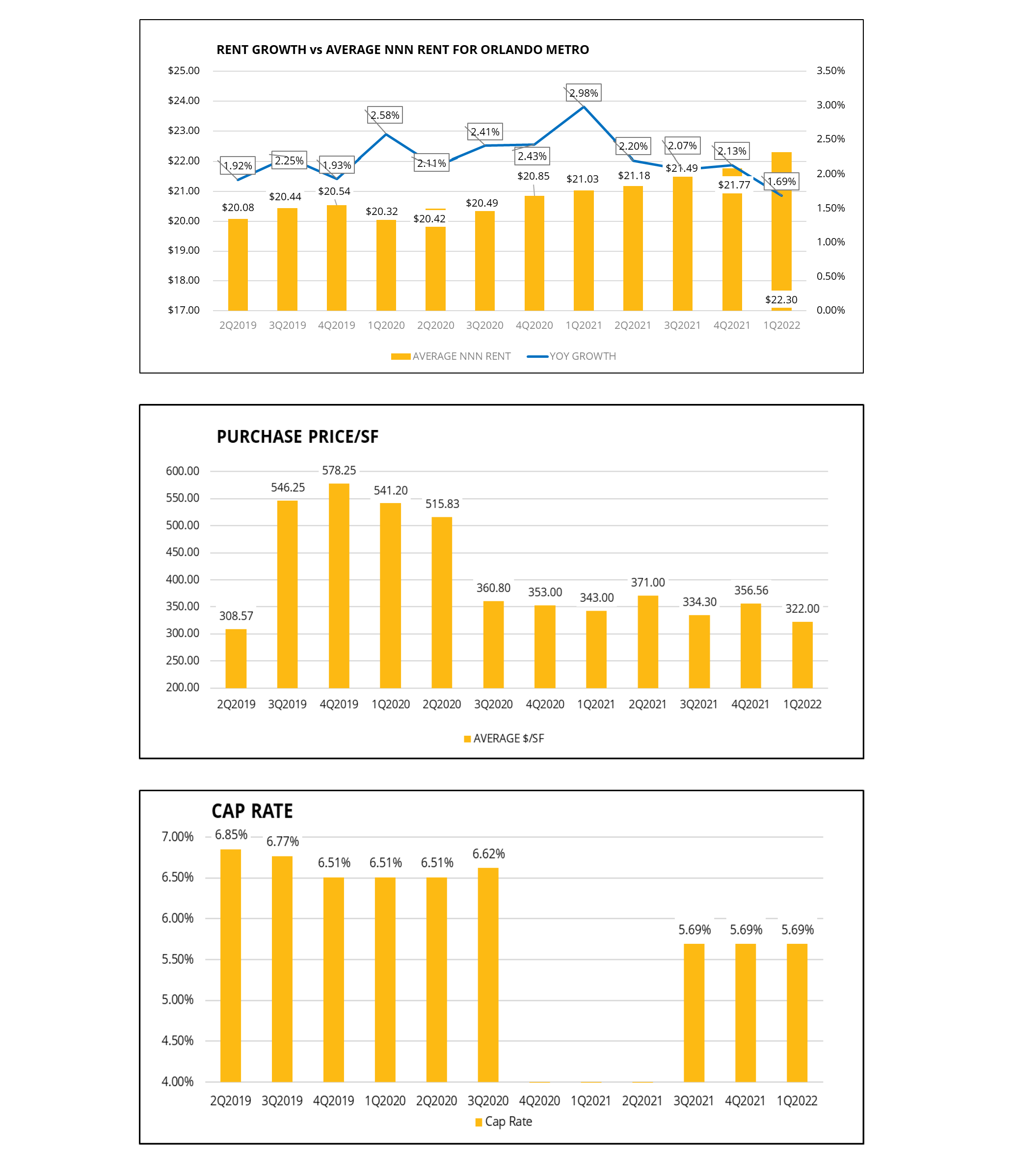

The eight metro reports from Revista, in which OrbVest is managing assets, have been added as a reference below. The data reflects the period in Q1 2022 that shows the recovery in the market post-Covid-19. As can be seen below, the impact of Covid-19 reflects differently in each metro.

DISCLAIMER

The content and information herein contained and being distributed by Orbvest are for information purposes only and should not be construed, under any circumstances, by implication or otherwise, as advice of any kind or nature, or as an offer to sell or a solicitation to buy or sell or to invest in any securities or currencies herein named. The information was obtained from sources believed to be reliable but is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. Past performance does not guarantee future performance.

Any market data or information used herein is for illustrative and informational purposes only. Please get the advice of a competent advisor before investing your money in any financial instrument or product and it is your responsibility to obtain the necessary legal, tax, investment, financial or any other type of advice in this regard.

Sources: REVISTA, WALL STREET JOURNAL, AVISON YOUNG RESEARCH, BLOOMBERG, DALLASFED.ORG AND U.S. BUREAU OF LABOR STATISTICS LATEST NUMBERS.