CEO UPDATE : TRANSCENDING INTO ACCRETIV AND BEYOND...

For those who did not follow the process, we received an overwhelmingly strong mandate from our Seychelles investors to proceed; which meant that we would deregister the individual listed entities and consolidate all interests into the new “AccretivPLUS Healthcare Portfolio Limited” and to create a single fund in the USA, namely “AccretivMED Real Estate Fund 1”. I can say that we have been kept extremely busy planning to make this all happen as seamlessly as possible and we are now ready to proceed.

We distributed the last of the Q4 quarterly returns and will now begin the consolidation. The first building acquired directly into the new structure in December 2023 was 4700 West Palm (Medical 43), a 100% leased prime medical building in a great location opposite the hospital. The first issue of shares happened on the 7th of February.

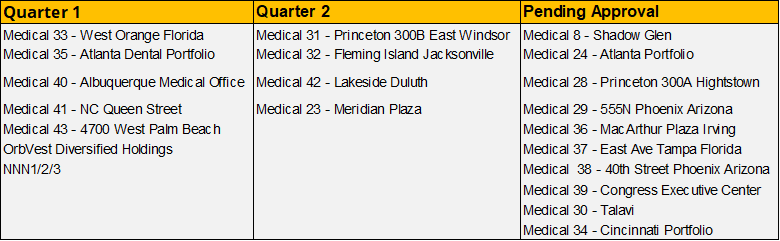

We plan to do the consolidation in phases to ensure there is no disruption and to make sure that current returns are maintained in AccretivPLUS. Projects that reflect as pending below may have minor budgeting queries that need to be resolved before we can include them, however, it is our stated goal to improve the performance of all the buildings and to have them all included in the coming 2 or 3 quarters.

We have also taken the opportunity to evaluate the Seychelles environment, especially with regard to the MERJ exchange, and decided to move the listing to the new SECDEX exchange. The SECDEX exchange is authorized and regulated by the Seychelles Financial Services Authority (FSA). This decision has been made in consultation with our broker and sponsor, PKF Capital who will remain our representative. The technology stack remains the same so there will be no difference to your experience. This does however provide some efficiencies and will simplify processes like the withdrawal of wallet funds, which should be greatly improved.

One of the key requests from investors was the ability to automatically re-invest their dividends and therefore compound their total returns. We are delighted to announce that Accretiv now offers a seamless re-investment process going forward.

We believe that over the next 18 to 24 months interest rates will begin to moderate and we are excited at the opportunity of acquiring buildings at significantly discounted prices to enhance our portfolio.

I would like to personally thank my entire team at OrbVest for the extraordinary effort they have expended over the past six months. The task was enormous and following up on over 4,000 DocuSign documents with stringent deadlines with certainly challenging. Thank you.

I would like to thank everyone for their continued support and your patience through this exciting transition and look forward to communicating more regularly this year and wish you well for the rest of 2024.

Martin Freeman

OrbVest CEO