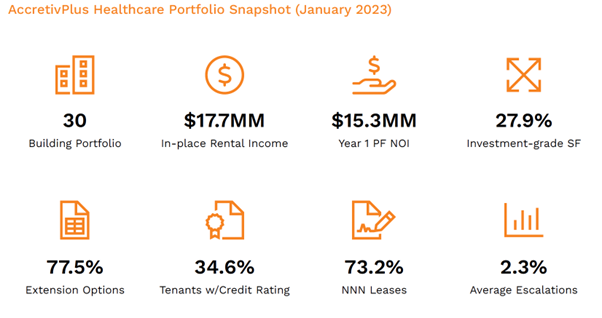

healthcare buildings across the United States, currently managed by OrbVest. The purpose of the consolidation is to assemble a large and attractive portfolio of stable income-producing healthcare real estate with the ultimate goal of generating a profitable exit in 5 years and a consistent quarterly dividend yield during this growth period.

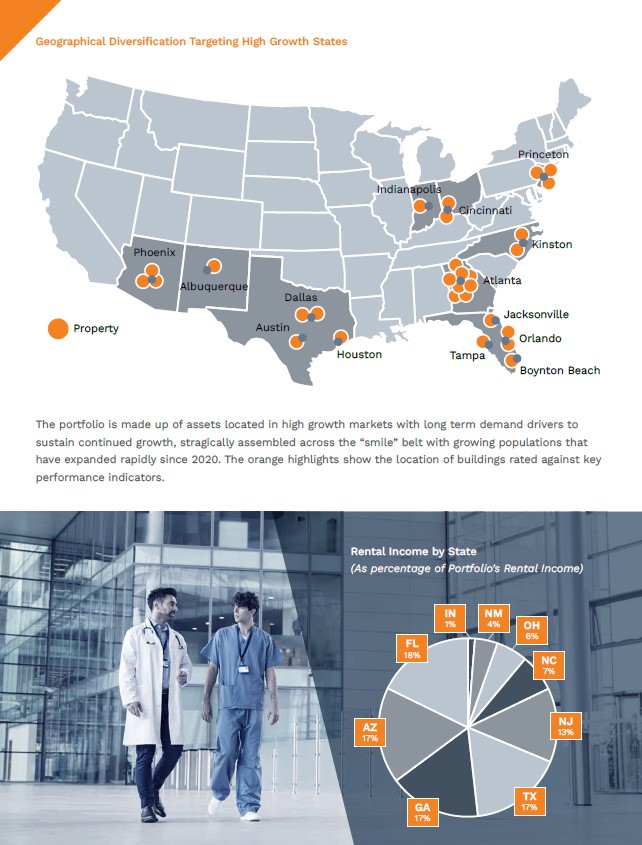

The identified target 30 buildings are all attractive profitable assets spanning 9 states predominantly in the smile belt and located in the fastest growing cities and counties, where income is derived from long-term leases entered into with an excess of 140 healthcare providers.

Stronger Together

The current portfolio has consistently distributed between 5% and 9% COC at project level. But the benefits of a portfolio will improve efficiencies and provide a significantly better outcome while also lowering the overall risk by establishing diversification. It also provides a platform to accelerate the growth and quality of the portfolio to take advantage of the opportunity where current economic conditions have created a strong buyer’s market.

*Note that the data displayed above shows the combined 29 buildings that have been identified for inclusion in the portfolio. Not all of these buildings will qualify for inclusion at the time of consolidation.